(Please read this footnote)1

Founded in 1923 as Allergologisk Laboratorium København, ALK-Abelló ($ALK-B.CO) is a €3.7 billion pharma company active in the development of solutions for the prevention, diagnosis, and treatment of allergies: it is indeed the global leader in tablet-based prevention for allergies such as grass pollen, tree pollen and house dust mites.

ALK has 3 classes of shares:

18.4 million A-shares (not public traded)

1.8 million AA-shares (not public traded)

202.6 million B-shares (listed on Nasdaq Copenhagen under the ticker ALK-B)

A- and AA-shares are almost all in the hands of the Lundbeck Foundation, which also owns ~35% of the B-shares and thus controls ALK with 40% of capital and 67% of the votes.2 The only other significant shareholder with more than 5% is ATP, the Danish state-controlled pension fund.

A short history

After more than 4 decades as an independent company, in the mid-1970s Allergologisk Laboratorium København posted consecutive years of losses and saw its finances stretched, to the point that in 1977 it was acquired by the Lundbeck Foundation. But negative earnings persisted and the need for capital to fund expansion led to Chr. Hansen Labs buying out all of the equity from the Lundbeck Foundation in 1979, maintaining the brand and operations of ALK separate.

The intertwined history of these three entities did not finish then, as in the late 1980s Chr. Hansen itself needed capital to fund major investments, too much to be raised through the existing ownership structure alone. So, in November 1989 the Lundbeck Foundation purchased 93% of the ordinary shares in Chr. Hansen: history had come full circle, with ALK owned by the Lundbeck Foundation once more, albeit indirectly.

In the early 1990s ALK occupied a strong position in the USA and was the market leader in Scandinavia and Central Europe. Yet its presence was almost non-existent in Southern Europe, despite collaboration with local distributors. One of the many reasons was the dominance of the Spanish company Alergia e Inmunología Abelló S.A: with its headquarters in Madrid and subsidiaries in Italy and Germany, the company was ALK’s strongest competitor in the European market, with sales at the time higher than ALK’s. But thanks to the financial troubles and corruption scandals embroiling Abelló’s Italian owner (the Ferruzzi Group), the Spanish company was acquired in 1992 for DKK 305 million, immediately doubling ALK’s revenues.

Jump few years ahead, and following the divestment of the ingredient business in July 2005 (acquired by the French private equity firm PAI Partners), the remaining businesses of the Chr. Hansen Group were merged with ALK, with the latter as the continuing company listed on the Copenhagen Stock Exchange.3

In 2018 ALK launched klarify.me, a new consumer platform to offer a broad range of pre-screened products for early allergy intervention, symptom alleviation and relief.

Business and products

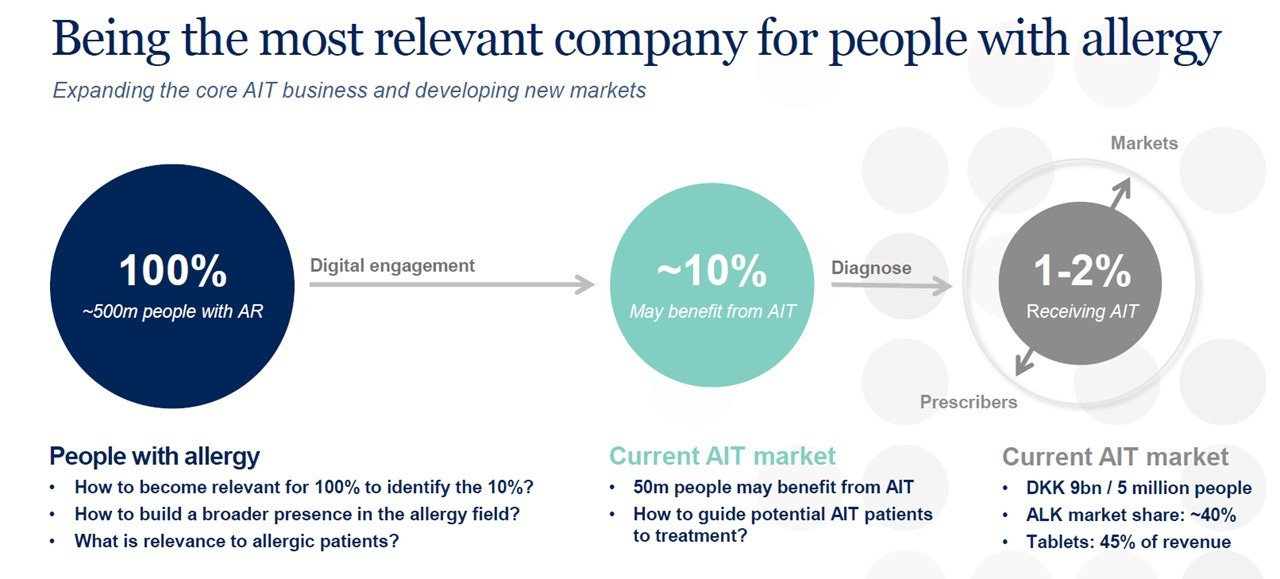

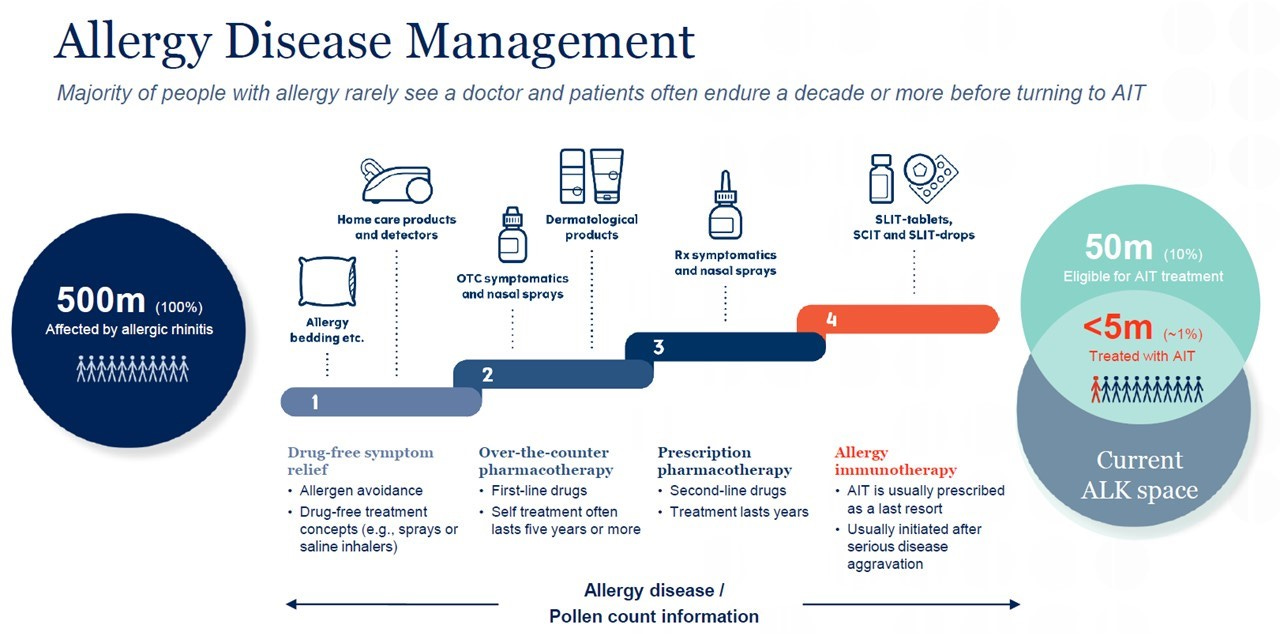

ALK is a world leader in evidence-based allergy immunotherapy (AIT), which treats the underlying cause of allergy, reduces or eliminates symptoms and provides long-lasting disease improvement: AIT works by giving repeated standardised doses of an allergen, thereby rebalancing the patient’s immune system to gradually build up an immunological tolerance. More than 500 million people worldwide have allergies (and 50 million suffer from severe allergies), but only 5 million do immunotherapy and only 1 million do tablet-based immunotherapy.

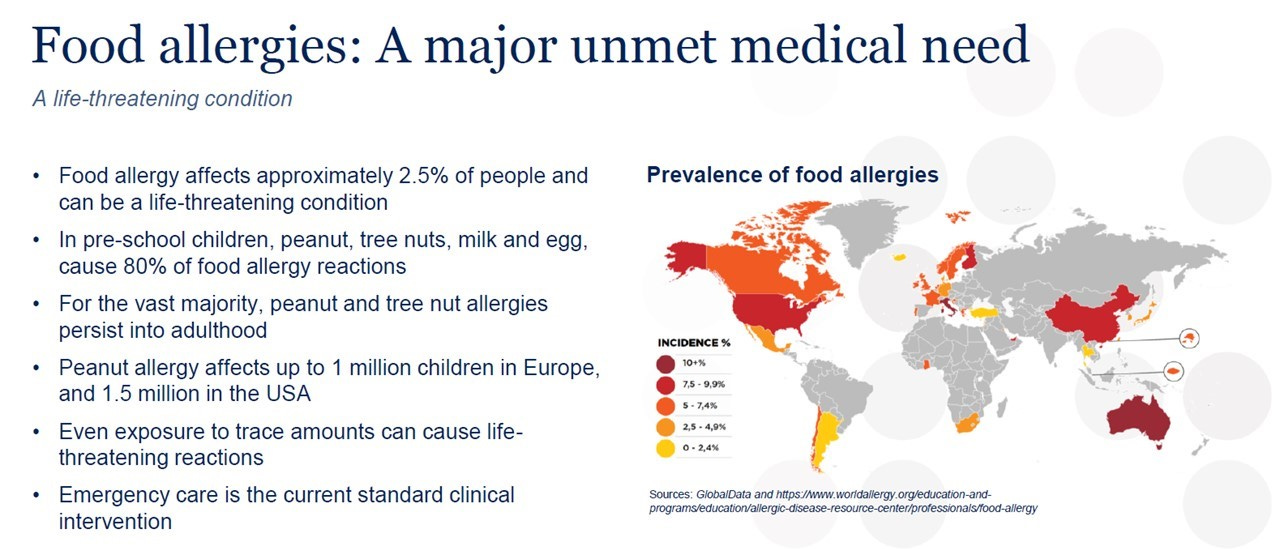

ALK offers products, services and resources covering a wide range of allergies, in addition to diagnostic allergy solutions through testing by skin prick test or blood test, and emergency treatment, such as intra-muscular injection of adrenaline for the treatment of acute life-threatening allergic reactions, including anaphylaxis. Since 2021 it also entered into food allergy treatment and began developing a tablet for peanut allergies.

ALK’s products come in three different forms:

Injections: subcutaneous allergy immunotherapy (SCIT) is given as regular injections under the skin, with the treatment administered by a doctor in clinics and hospitals

Sublingual drops: sublingual allergy immunotherapy (SLIT) drops are administered under the tongue directly by patients at home, avoiding the need for regular visits to the doctor

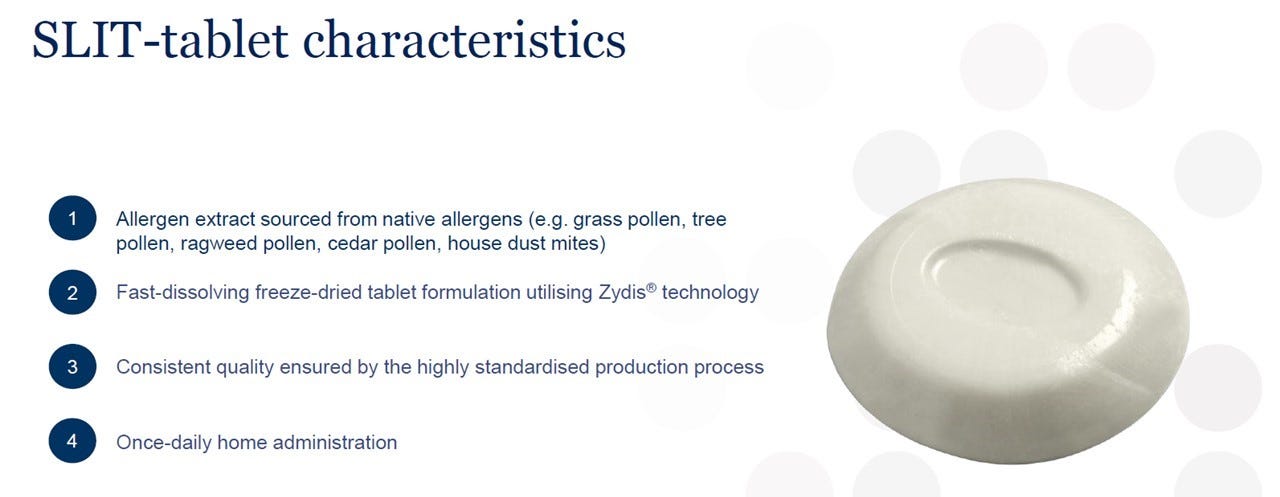

Tablets: SLIT-tablets are administered by the patient at home, are available for all the most important respiratory allergies and are the best-documented AIT treatment

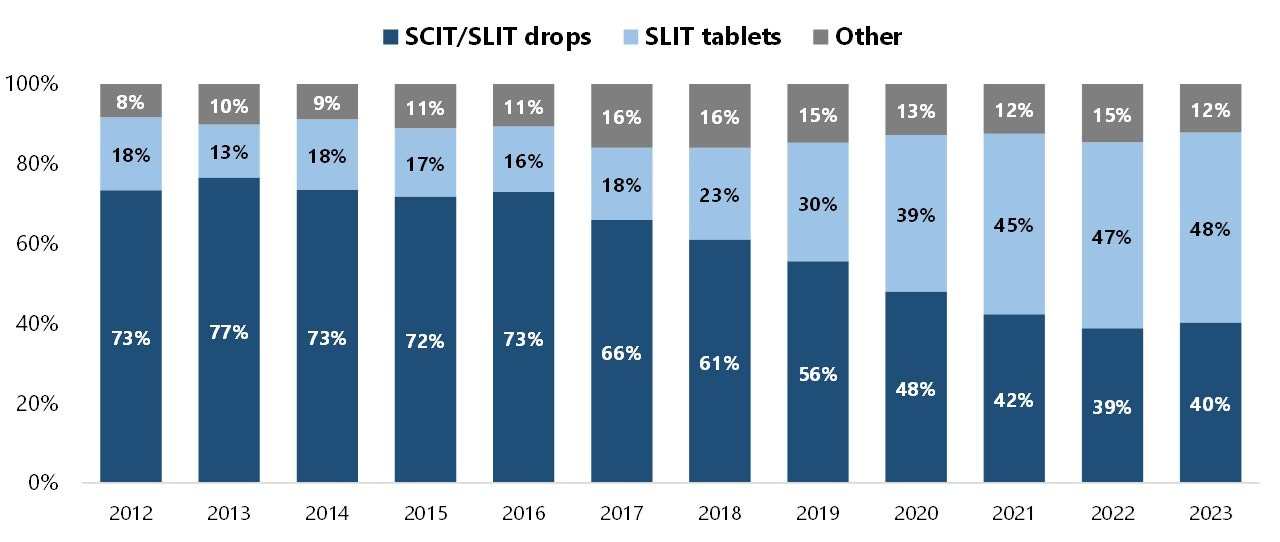

As a testament to its R&D prowess, ALK was the first company to launch a standardised allergy immunotherapy in 1978 and in 1990 it introduced the first sublingual allergy immunotherapy drops (SLIT-drops). In 2006 the world’s first sublingual allergy immunotherapy tablet (SLIT-tablet) was approved in Europe.

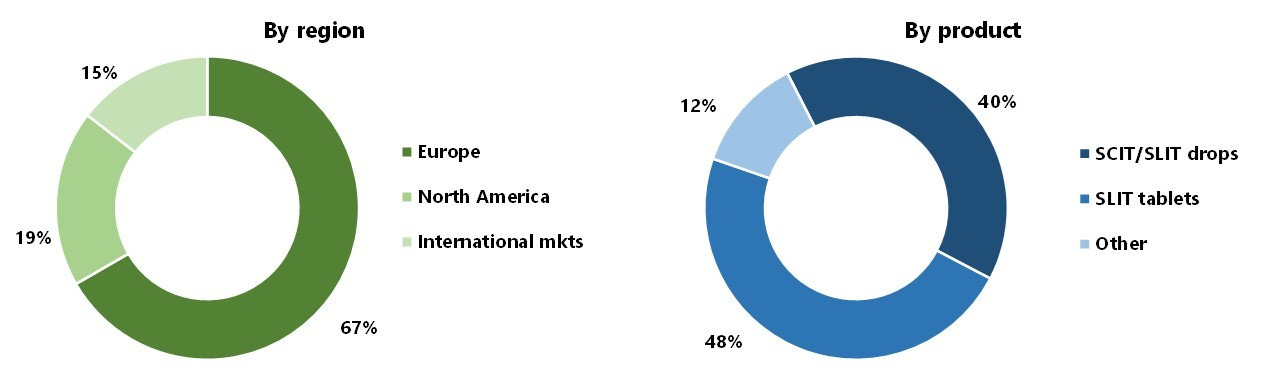

Revenues are so divided:

While injectables used to represent the majority of revenues, they have shown a very modest growth of ~1% p.a. since 2015; on the other hand, tablet-based therapies have grown at >15% p.a. ALK’s tablets cover five of the most important respiratory allergies: grass, house dust mite, tree pollen, ragweed, and Japanese cedar.

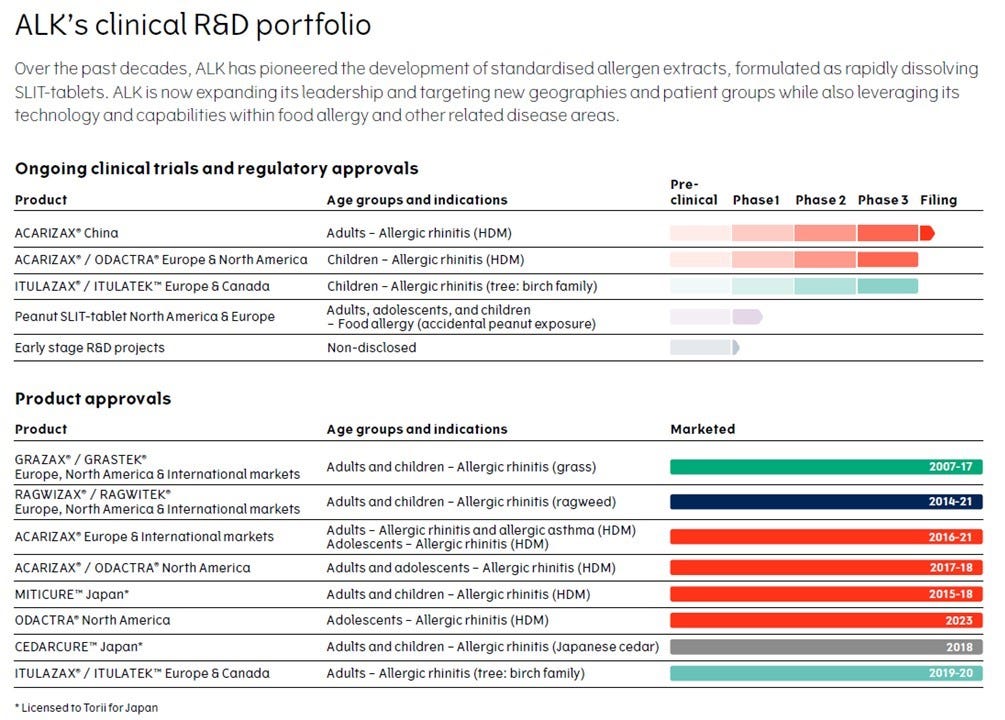

In more detail these are ALK’s products already on the market and its pipeline:

The market and competition

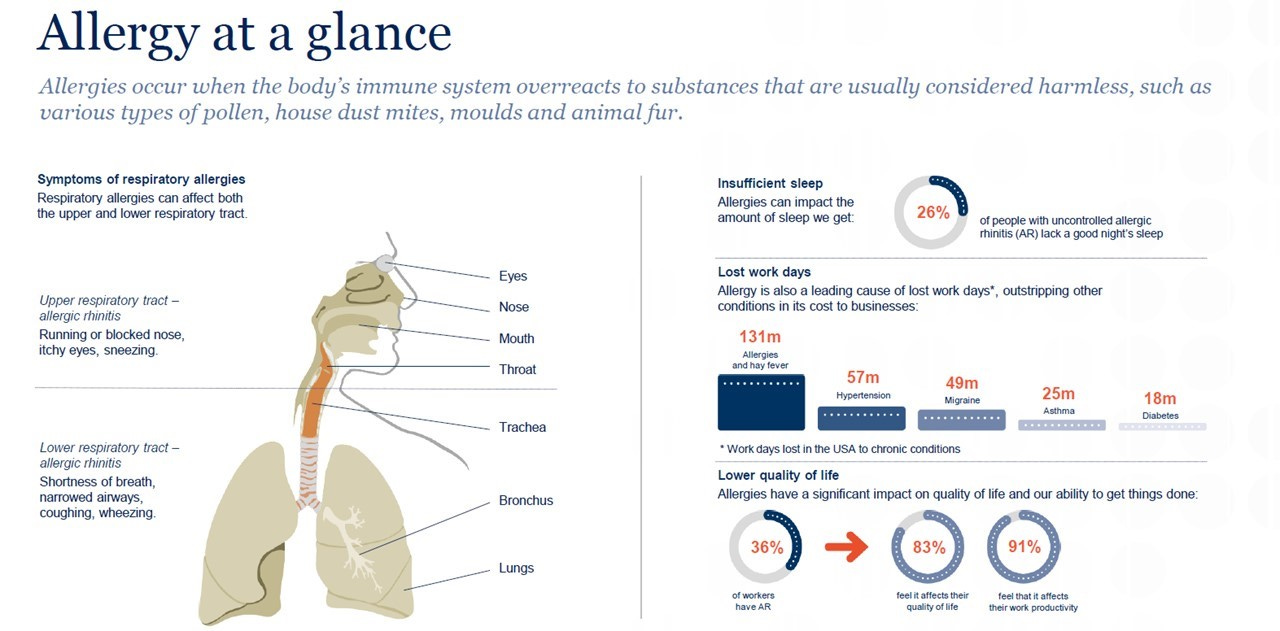

An allergy is a disorder of the immune system which reacts to normally harmless foreign substances such as house dust mites, pollens, or certain foods.

Allergies in humans cover a variety of symptoms which can range from mild to severe: if left untreated, they can worsen over time. The most common forms of allergies are outdoor pollen from grass, hay, and tree, but can also come from traffic-related polluting emissions. Indoor allergies come from house dust mites, mould/mildew and pets with fur. Food and drink allergies are from milk/diary products, nuts/hazel, peanut, seafood, gluten, …. Animals can also suffer from many of the same ailments as people, with their allergies falling into three categories: environmental, food and insect-bite allergies.

According to Stallergenes, approximately 30% of the world population is affected by one or more allergic conditions and it is expected that by 2050 several billion people will suffer from allergies. The increasing prevalence and intensity is a trend that has continued in the industrialised world for more than 60 years: allergies are getting more and more widespread due to a mix of factors such as inheritance, environmental changes, and modern lifestyle.

Allergic rhinitis affects approximately 10% to 30% of adults and 40% of children, with the often-underestimated consequence to put people at a greater risk of developing asthma. But only 12% of them are treated with allergen immunotherapy products due to low awareness among physicians and patients, a complex treatment pathway and a market that is dominated by lower cost symptomatic treatments: most people self-treat with over-the-counter drugs and do not seek the advice of specialist doctors. AIT is the only treatment that addresses the underlying cause of allergy and may provide both rapid (within a few weeks) and long-lasting (several years) improvement of all symptoms, whereas symptomatic treatments (such as antihistamines and corticosteroids) only temporarily relieve some allergy symptoms.4

Market growth should result from increased awareness of respiratory allergies, easier access to allergists, the expanded range of administration modes as well as a growing middle class in developing countries that will gain access to medical treatment. As more patients seek treatment for their allergies, the AIT industry is gaining greater attention from the healthcare community. Healthcare providers are seeking more clinical evidence related to the safety and efficacy of AIT; and regulatory bodies are intensifying their scrutiny of, and enacting more stringent requirements on, biologics manufacturers.

As usual, estimates on the size of TAM vary depending on definitions and methodologies. The total allergy treatment market – which includes antihistamines and other treatments as well as immunotherapy - is probably just above US$20 billion, and is expected to grow at around 8% over the remaining of this decade (source: Mordor Intelligence). The pure allergy immunotherapy market is around US$2 billion (source: Spherical Insights), but it's growing faster at ~10% p.a. and expected to reach $4.5 billion by 2030. Europe is still the largest region and Asia-Pacific the fastest-growing: with 2/3 of revenues from SCIT injections and 1/3 from SLIT tablets ALK dominates the fast-growing SLIT segment with around $330 million in revenues.

ALK is directly present in 46 markets and partners with other pharmaceutical companies to commercialise its tablets, including Torii in Japan, Dr. Reddy’s in India and Abbott in South-East Asia. In addition to divisions of Big Pharma (Merck, Johnson&Johnson, Novartis, Sanofi, GKS, AbbVie, Teva, Roche), some of ALK’s direct competitors include:5

Stallergenes Greer (Switzerland, private)

Allergy Therapeutics (UK)

HAL Allergy (Netherlands, private)

HollisterStier (US, part of Jubilant Pharma)

LETI Pharma (Spain, private)

DBV Technologies (France, private: clinical stage biotech company focused on food allergies)

Circassia Pharmaceuticals (UK, part of NIOX Group, listed)

ASIT Biotech (Belgium, private: clinical stage immunotherapies)

Dermapharm Holding (Germany, listed: includes the former Merck KGaA allergy activities)

Alembic Pharmaceuticals (India)

ALK’s business model is centred around strong R&D skills, insight into immunology and unique manufacturing processes: as AIT treatments are classified as biologics because they are produced from living cells rather than being synthesised by chemists, intricate manufacturing processes present significant barriers to entry and ensure a sustained market exclusivity.

Quite interestingly, in 2020 Nestlé bought Aimmune Therapeutics (a biopharmaceutical company developing and commercialising treatments for potentially life-threatening food allergies) for US$2.6 billion and included it in its own Health Sciences segment in “the constant pursuit of innovative, science-based nutritional solutions to support healthier lives”. However, after just three years and sluggish sales, last year Nestlé sold part of this business to Stallergenes after having already wrote down most of the value from the acquisition.

Financial performance

As a listed company, ALK financial performance can be split into four different periods.6

After the spin-off in 2005, ALK enjoyed a couple of years of excitement over the approval of the grass pollen tablet GRASAX. But the stock price got too far ahead of itself (+160% in slightly more than 12 months) and shortly after corrected ~80% in a couple of years as the growth from SLIT tablet sales took much longer than investors had factored into the stock price.

During the next period from 2009 to 2016 the operating modus was more on having acceptable growth and good cash flows: the stock price recovered from the previous growth disappointment and multiplied by 4x.

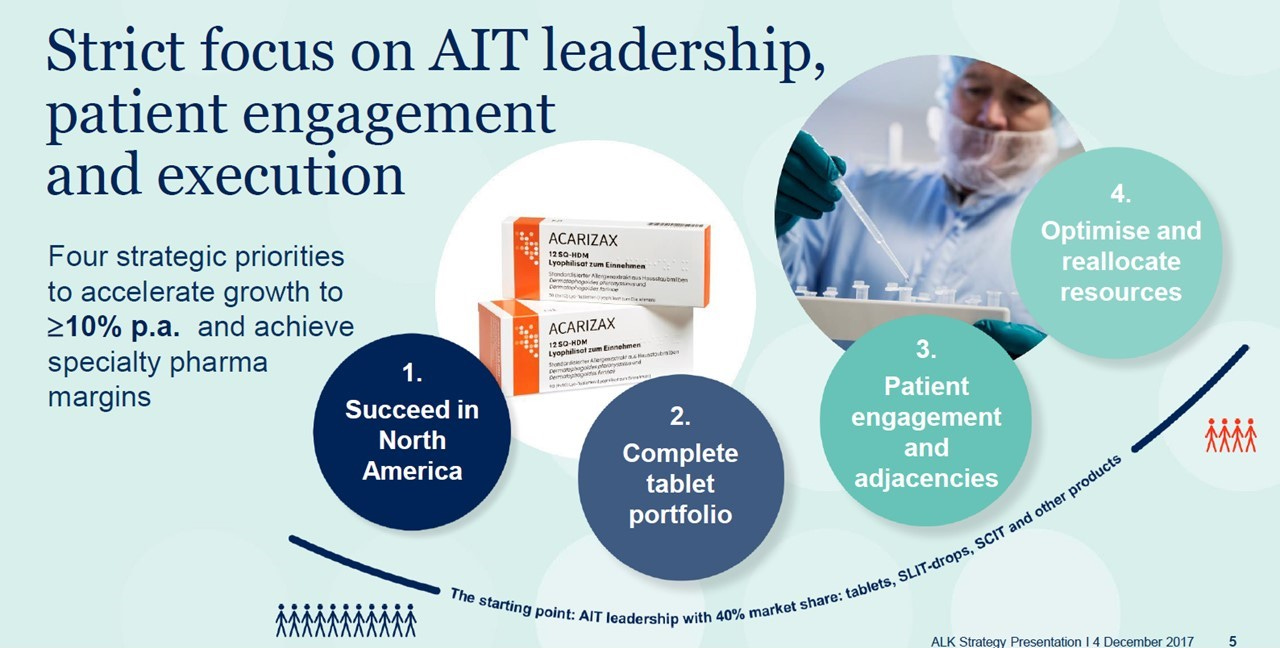

Things however changed in July 2016: for the expansion of tablet-based allergy prevention in North America, ALK had partnered since 2007 with Merck, but the US company unexpectedly pulled out of the partnership and ALK share plunged 18% in one day. That left ALK to nurture the SLIT tablet business alone, and the new CEO Carsten Hellmann announced a complete reset for faster growth and better profitability:

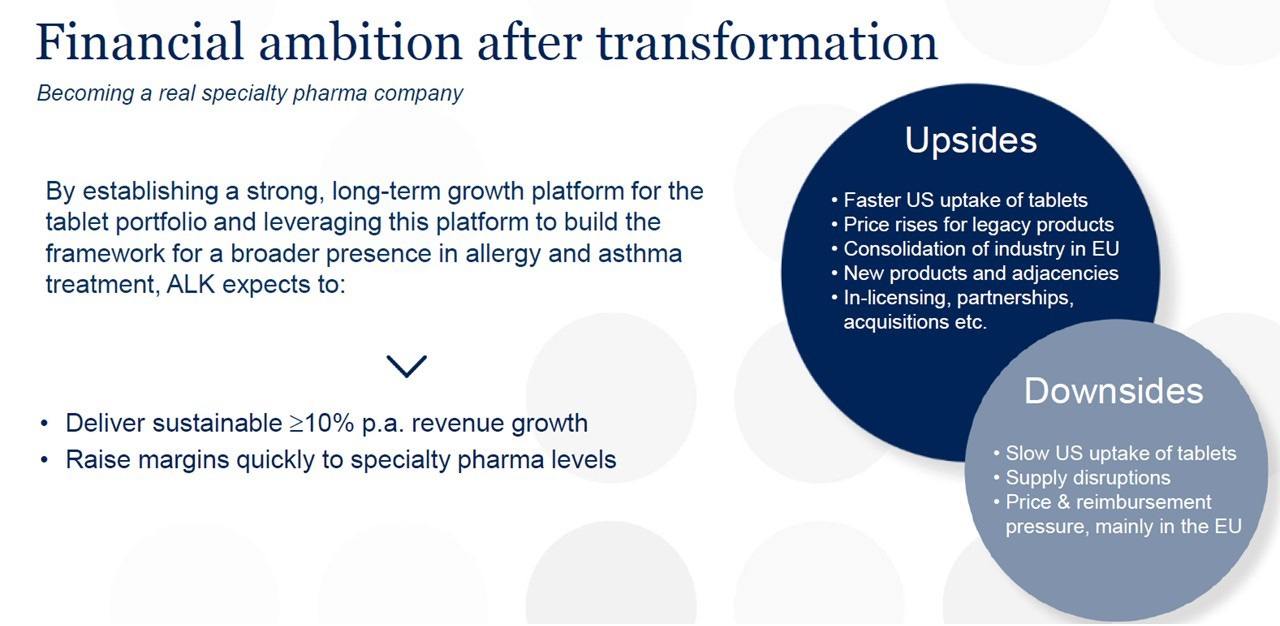

“ALK has adopted a new corporate strategy to redefine its position in the global allergy market and stimulate a new era of growth for the company. The strategy aims to transform ALK into a broader-based allergy company, by expanding its core AIT business and using its expertise to grow the tablets franchise in particular, and to introduce new, complementary products and services that reach even more people with allergy and asthma.” (Annual report 2017)

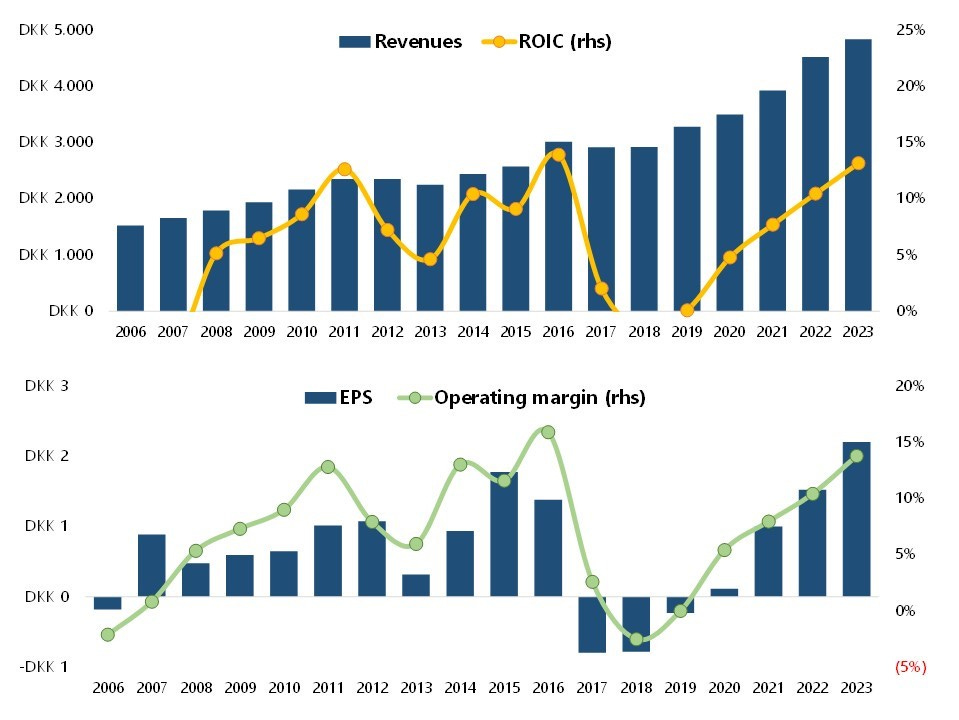

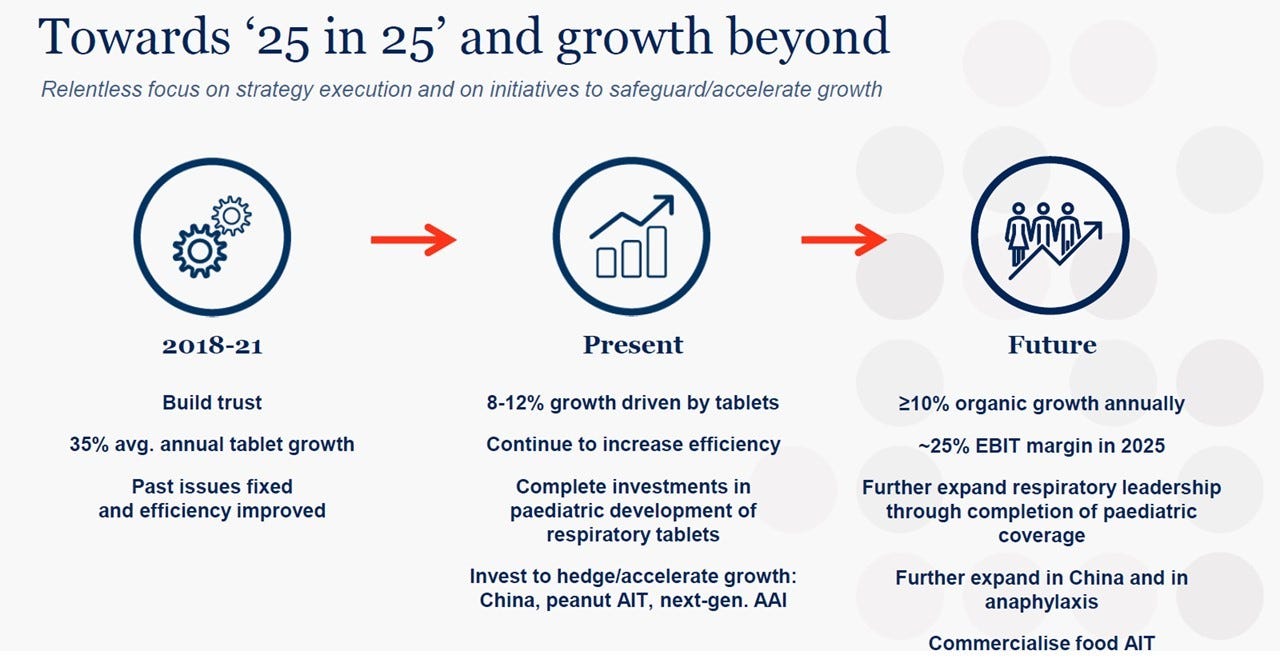

In particular, the company focused on a better allocation of resources (point #4) with the key objective of improving efficiency and structural effectiveness so to free up capital for new businesses and improve margins. That meant a prolonged period of higher costs for R&D, sales force infrastructure, distribution, …, and a ~€100 million capital raise in 2017. While revenues were only marginally impacted, ROIC, operating margins and EPS were all significantly lower from 2017 to 2019.

The changes were clearly telegraphed (“Subdued earnings over the next three years”; “Total negative cash flow”; “greatest effect in the next two years”), but the market reaction was a ~20% decline in the stock price to DKK 35. Even though it was the right long-term decision, few companies would have done such a strategic reset without the support of a long-term oriented majority shareholder like the Lundbeck Foundation.

The strategic “repositioning” has now been completed and market scepticism has faded: the next step is one of flawless execution on the growth and profitability potential. The mandate of the new CEO, Peter Halling, officially appointed on 1 January 2024, is to grow as fast as possible while improving operating margins and cash flows.

Valuation

Since the introduction of the new strategy in 2017, ALK has generated roughly €300 million (cumulative) in cash from operations: roughly €400m have been reinvested in the business in the form of working capital and capex (there have been no acquisitions in the last 6 years). The company paid a dividend from 2008 to 2016 but that has been scrapped since 2017, and only nought back shares to sterilise management compensation. With most of the debt paid down using the proceeds of the equity raise (today net debt is less than DKK 300 million / €40 million for a net debt/EBITDA ratio of just 0.3x), it could start again paying dividends in the near future.

The current valuation multiples are as follows:

EV/sales: 5.9x

EV/EBIT: 43x

P/E: 57x

FCF yield: ~1%

Guidance for the entire 2024 is for revenues to grow between 9% and 12% (in local currency: growth has indeed been in the 10%-12% over the last 3 and 5 years), with a stable gross margin and further improvements in operating margin to 17% to 19% (vs 14% in 2023), thanks to a decline in R&D expenses – as a percentage of revenues – from 13% to around 10%.7 Using the mid-point of the guidance, the forward multiples fall to:

EV/sales: 5.3x

EV/EBIT: 29x

P/E: 38x

The only other pure allergy listed pharma company is Allergy Therapeutics, which is however 1/10th of ALK in terms of revenues. NIOX Group is also significantly smaller, while Dermapharm is significantly bigger but also involved in the manufacturing and distribution of off-patent branded products not in the allergy category (over-the-counter non-prescription products such as herbal extracts, vitamins, minerals, food supplements, dermatology, pain and inflammation treatments, cardiovascular support, gynecology, and urology).

ALK’s closest peer is Stallergenes Greer, which was taken private in 2019: Waypoint/Ares Life Sciences had been a majority shareholder (77%) of Stallergenes since 2015 and masterminded the merger with Greer Laboratories (which it owned 100%), and finally took the new company private in 2019 at an equity value of €730 million (EV €679 million), equivalent to an EV/Sales of 2.5x and and EV/EBIT of 33x. In 2022 Stallergenes recorded €360 million in sales, so roughly ~60% of ALK’s revenues in that year.

Final thoughts

My usual “plus and minus” of an investment.

Plus

Biggest pure allergy pharma company with an excellent track record of innovation

Leader in the faster growing segment of tablet-based treatments, which will continue to be the main driver of its fundamentals (including in the new food allergies category)

It has not held a Capital Markets Day since 2013 but it’s having one on 4 June: this should be the opportunity for the new CEO/management to clarify future uses of cash

Minus

The roll-out of new solutions is steady but still a lengthy process: only 1% of patients are moving towards immunotherapy

It also quite expensive: it requires serious investments to stimulate growth, as parents with allergic children must be “educated” and made aware of the treatment and prevention possibilities

If growth does not materialise as expected, it will hurt profitability as expansion costs are already in execution mode

Biggest risk is valuation and a repeat of what happened two years ago: the stock also traded at P/E 60x at the beginning of 2022 and subsequently declined ~55% in the following 18 months to August 2023

Personally, ALK is a bit expensive for my tastes (forward multiples are not extreme, but the stock is already up ~25% YTD), but definitely a company worth keeping an eye on. It could be a good takeover candidate by a strategic acquirer or even private equity: it has low debt, steady growing revenues/cash flows and it’s trading at a forward EV/EBIT multiple below what was paid to take Stallergenes private. But I wouldn’t build much of a takeover premium in the valuation, as the shareholder structure makes an unsolicited acquisition impossible.

I’ve now finished the project that kept me occupied for the last 4 months: I now have more time to update my models, research new companies and, hopefully, for writing. As a consequence, I’m also considering whether to move to a subscription model: I haven’t decided yet but it’s a possibility. The new “model” would probably entails shorter analyses (but not less detailed) with a higher frequency. The “type” of companies will remain the same.

Lundbeckfond Invest (the investment arm of the Lundbeck Foundation) is also the majority shareholder in H Lundbeck A/S (another Danish biotech company focused on psychiatric and neurological disorders) and Falck A/S (healthcare, assistance and emergency services, not listed) and a significant shareholder in Ferrosan Medical Devices and Ellab, in addition to investing in an international portfolio of early-stage biotech companies.

Chr. Hansen was re-listed in 2010 and last year it merged with another Danish company, Novozymes, to form Novonesis. The name “Novo” recurs because all these companies are somewhat related to Novo Holdings A/S, another foundation that manages €150 billion and has stakes in Novo Nordisk, ConvaTec, Evotec, Invisio, Oxford Biomedica, in addition to Chr. Hansen / Novozymes and dozens of other start-ups mostly in the life science sector.

It takes more planning to boost the immune system, but the long-term outcome is much better for a good life not interrupted by allergic episodes. The AIT tablet treatment costs around €3-10 per week or €150-500 per year and is as such a relatively inexpensive cure.

It also competes with Mylan and Adamis Pharma in the epinephrine pens market.

Some databases include the stock performance prior to 2005 as it reflects the Chr. Hansen period, but strictly speaking that was a different listed company.

This reduction reflects the completion of two large-scale clinical Phase 3 programmes for tablets in 2023, enabling ALK to progressively reallocate resources to areas such as food allergies and other innovations.

You must be happy today. :-)