Bi-weekly recap #2

Sensirion

Already last summer, Sensirion surprised the market with a profit warning, when it announced that revenues were going to be 20%-25% lower and EBITDA margin would halve “due to challenging market environment”.

And 2023 was indeed a challenging period with a topline setback after three booming years: revenues were down -27.5% (-15.5% organic, -8.8% due to one-offs and -3.2% due to fx), gross margin somehow managed to stay along the historical levels but the EBITDA margin did much worse than just halving, crashing from 28%-30% to 4%. Particularly hit were the appliances and consumer markets (for medical it was kind of expected after the Covid boom), while for automotive growth was actually positive.

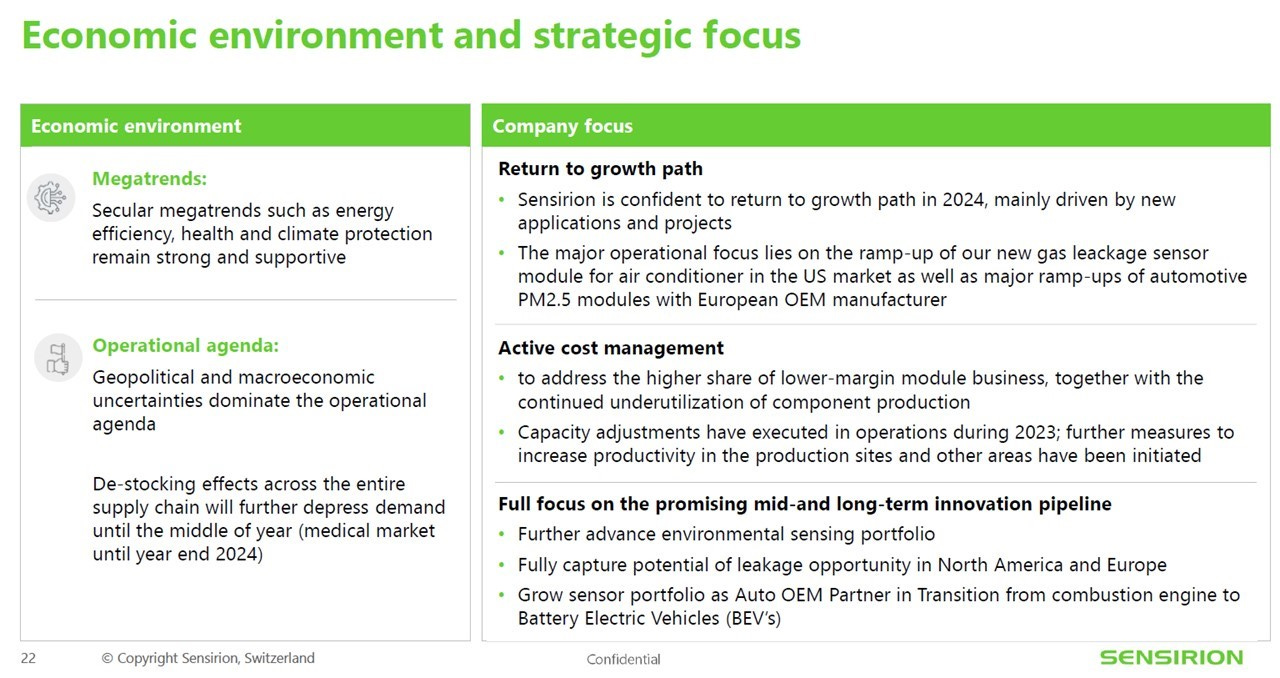

Despite the slowdown, R&D and operating expenses increased vs the previous period, thus pushing operating margins into negative territory. The company justified these actions as necessary to sustain “the strong innovation pipeline and to enable significant product launches in new applications in 2024 and 2025.” But 2024 will be another transitional year in terms of profitability. On the positive side, the company does not have any financial debt, apart for some small operating leases.

The stock was (surprisingly) only down -15% in 2023, and a further -10% YTD: it was however around 25% in May on no real news (Sensirion does not provide quarterly updates, the next financial info will be released in August for the first half of 2024).

Acomo

Similarly, Acomo also posted negative 2023 results: revenues were down -11%, operating margin -16% and net profits -27%. However, gross margin was actually up (14% vs 13% the previous year), and cash flows were helped a lot by improvements in working capital management. Debt has also been reduced at a rapid pace.

Its business segments performed differently. Spices&Nuts (roughly 1/3 of revenues) performed well: despite a small decrease in sales (-2%, mainly due to market price developments of several product groups), a positive volume effect led to a +27% in operating profits. The biggest problems were in Organic Ingredients (another third of revenues), which was materially impacted by the unprecedented cocoa prices, resulting in lower demand and losses on hedging.

Also on the negative side: CEO Kathy Fortmann, in charge since 2021, abruptly resigned in October “for personal reasons”, with the CFO Allard Goldschmeding assuming the CEO role at interim (he has now been nominated permanently to the position).

The stock lost -8% last year and is flat YTD. Acomo also report only on a semi-annual basis.

Big movers

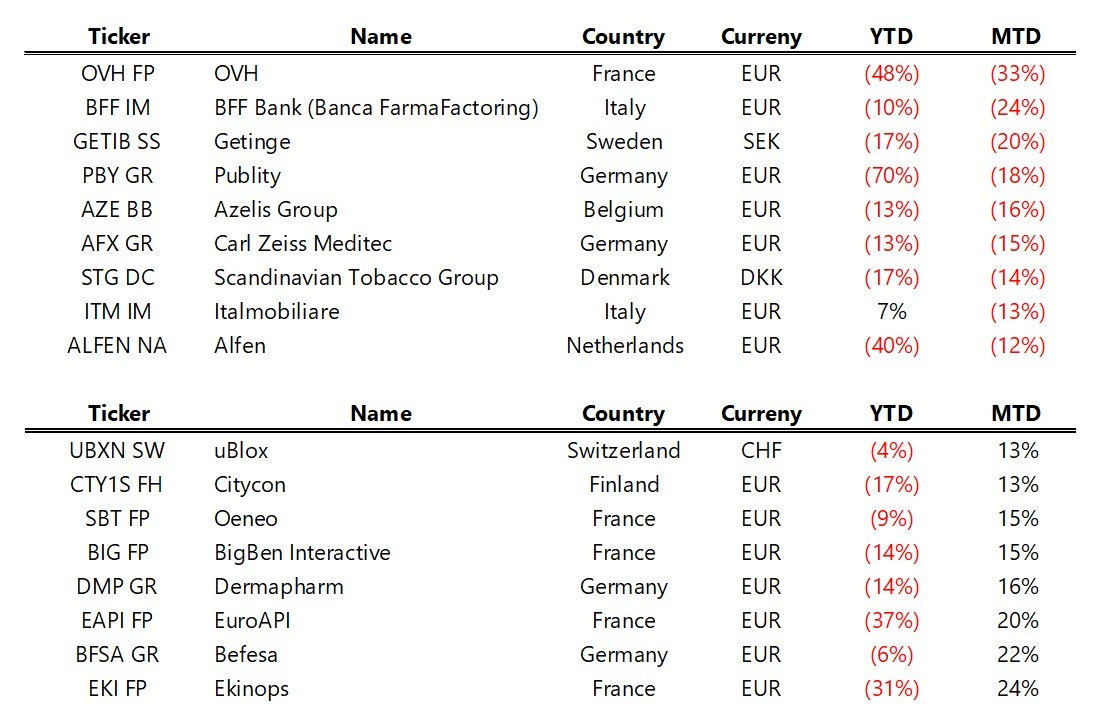

Companies in the European (ex-UK) SMID space with “big movements” (both up and down) during the month of May and that are worth researching further:

Interesting readings

The Cazique of Poyais: a Real Estate illusion in the new world

AlphaPicks: Meet The Code Breakers

Stock pitches

Rijnberk InvestInsights: MercadoLibre

The Dutsch Investor: Kering