Gerresheimer AG

A short(er) note: potential activist catalyst, but will require time

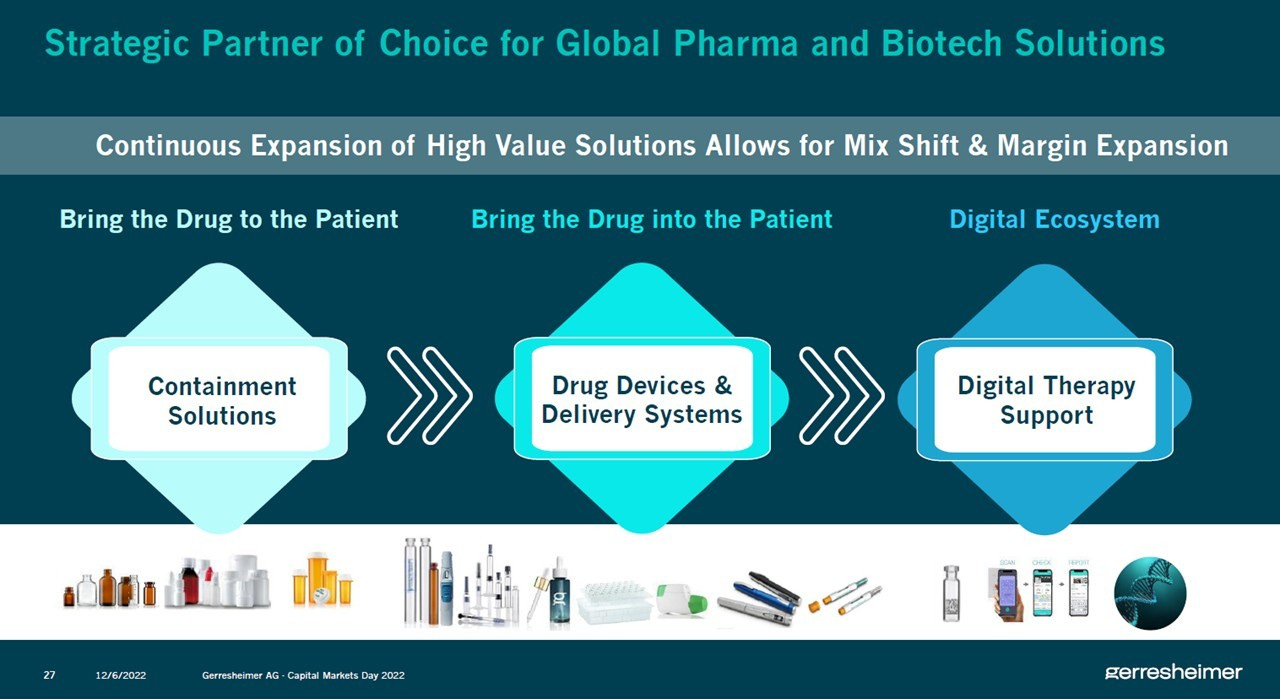

With origins dating back to 1864 as a small glass factory in Düsseldorf, Gerresheimer ($GXI.DE) is a leading player in both Containment Solutions (“getting drugs to the patient”) and Delivery Systems (“getting drugs into the patient”).

Gerresheimer was acquired by Blackstone in 2004 from previous private equity owners Investcorp and JP Morgan Partners (price not disclosed) and IPOed in 2007 at €40 share, at an equity value of €1.2 billion (Blackstone kept a 25% that then sold in 2008). Today the market cap is €1.6 billion.

GXI operates through three divisions:

Plastics & Devices (P&D, 56% of revenues, 25% EBITDA margin): drug delivery and system solutions for liquid and solid medicines; includes ready-to-fill plastic syringes and injector pens, plastic bottles for drug filling, inhalers and containers for tablets and powders. GXI’s contract manufacturing services involve outsourcing production steps for clients, including major pharmaceutical companies like Novo Nordisk and GlaxoSmithKline

Primary Packaging Glass (PPG, 44% of revenues, 20% EBITDA margin): glass vials, cartridges, and ampoules for the pharmaceutical industry, as well as containers for fragrances and skincare products and glass bottles for food & beverage applications

Advanced Technologies (AT, 0.3% of revenues, negative EBITDA margin): development projects, including digital platforms for therapy support and wearable medication pumps for small- and large-molecule drugs

Revenues are generated for 60% in Europe (of which Germany ~20%), 27% in US and the rest in emerging markets. More than 80% is from pharma/biotech companies, with the balance being cosmetics and food&beverages.