[I’ve changed the periodicity of these recaps, as I’ve realised I don’t have much to say every two weeks…]

Ashmore

Ashmore, a UK-based, London-listed global asset manager specialised in investing exclusively in emerging markets, was introduced more than two years ago in April 2022: since then the stock price is down -7% (in GBp) but you would have received +15% in dividends, so overall the position is up ~9%.

In short, the long thesis was:

A long-term opportunity: more and more people/GDP/wealth are in EM strong drivers of growth and economic convergence to developed countries

Low index representation and other market inefficiencies offers opportunities for active management

Valuations are more affordable than in developed markets

At the time, the company also looked cheap on an earnings basis (P/E 12x, dividend yield 7.5%).

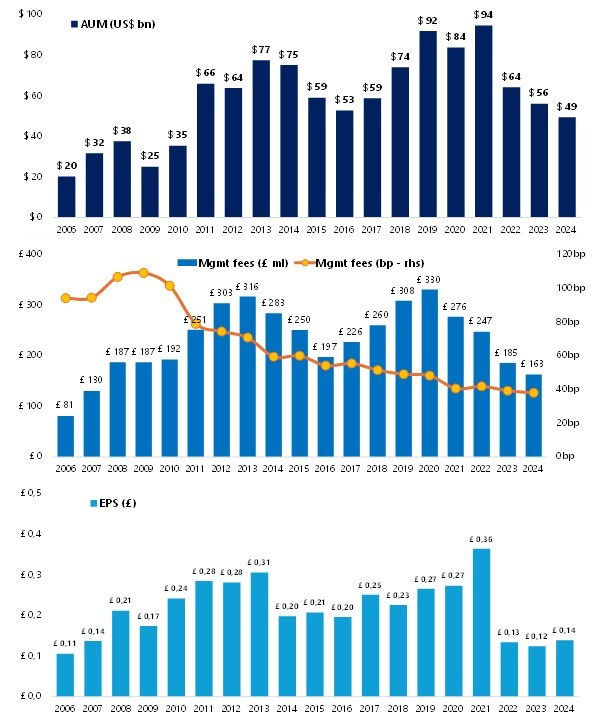

The problem is that AUM are downs sequentially over the last 4 years: ASHM lost US$45 billion since 2021 (-47%), with the decrease mostly due to net outflows, not weak underlying performance. Management fees followed a similar path (-50% since the 2020 peak), ROE contracted (~10% for the last 3 years), and EPS are at the same level as in 2007!

In the initial post I did point out to the risk of AUMs disappeating:

The main risk remains the inherent volatility of AuMs, which may not be as stable as desired, especially in a sector like EM. Ashmore would certainly do well to learn from the experience of Artio Global Investors, which is well described in this article from few years ago (Financial Times).

However, I assumed (incorrectly, most likely) that one of ASHM’s strengths was its client base, mostly composed of long-term oriented, less “fickle” institutional investors (pension plans, sovereign wealth funds, central banks, financial institutions). That does not look so stable right now. Fee pressure has also not abated, with average earned fees down another 2 bps to 38 bps (-3% CAGR over the past five years), particularly hit in the external and corporate debt strategies (-9% and -11% CAGR in management fees, respectively, over 5 years). Performance fees have slightly recovered to 5 bps in 2024, but are still insignificant compared to 15 years ago when they were normally 30 -40 bps (and a much larger percentage of total income fees).

It appears that, similar to other asset classes, EM debt markets are also becoming more “efficient” (i.e., less easy alpha available), and that investors are ok with (quasi)passive strategies.

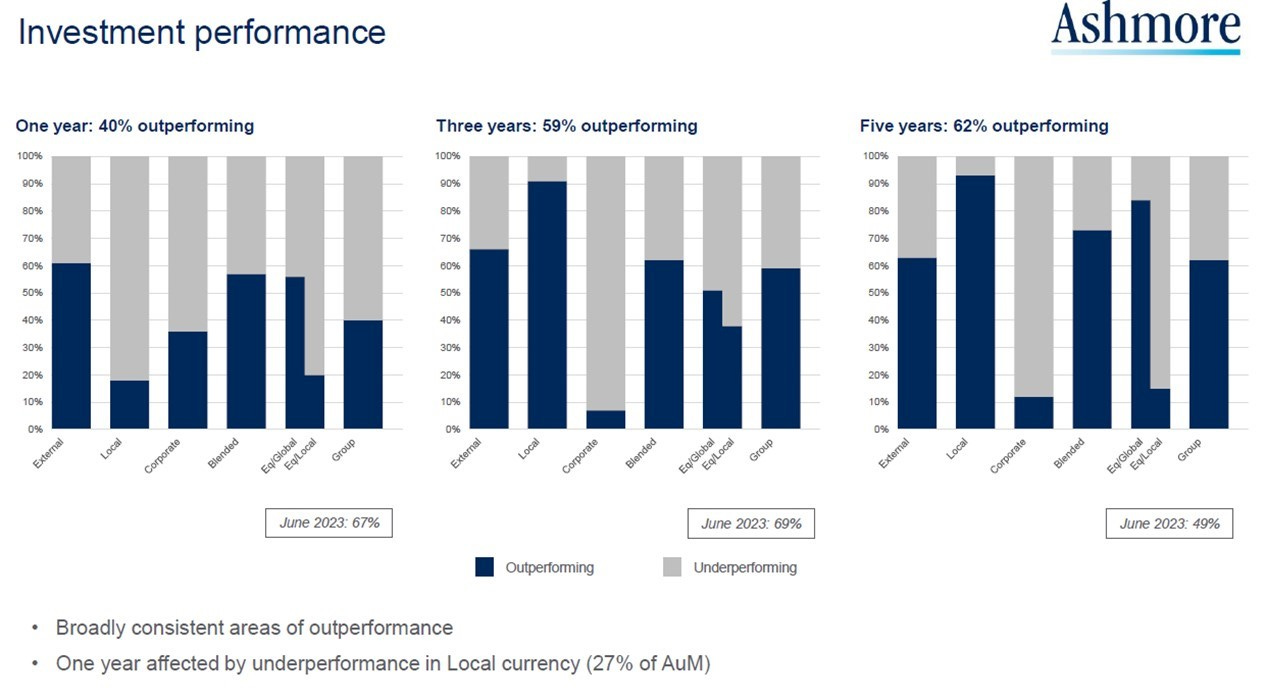

ASHM own track record is a bit better than a couple of years ago, but performance is still very mixed and not really satisfactory (at best only ~60% of the strategies are beating their benchmark over the medium-term term).

My conclusion two years ago to be cautious and to stay out of EMs was mostly correct but not for the right reasons: I was wrong on the macro call, as EM did decently well over the last 12 months (index returns for ASHM different strategies were between 1% and 13%, with EM fixed income assets outperforming developed markets and equities also had strong returns notwithstanding headwind from China).

Today, ASHM trades at a P/E of 15x for a ~8% dividend yield. This bit is still valid, tho:

People often see a P/E of 10x-15x and say: “See, it’s not expensive and it’s cheaper than its historical average!” That can be true, but only if earnings can’t halve; if they can, it could be very expensive.

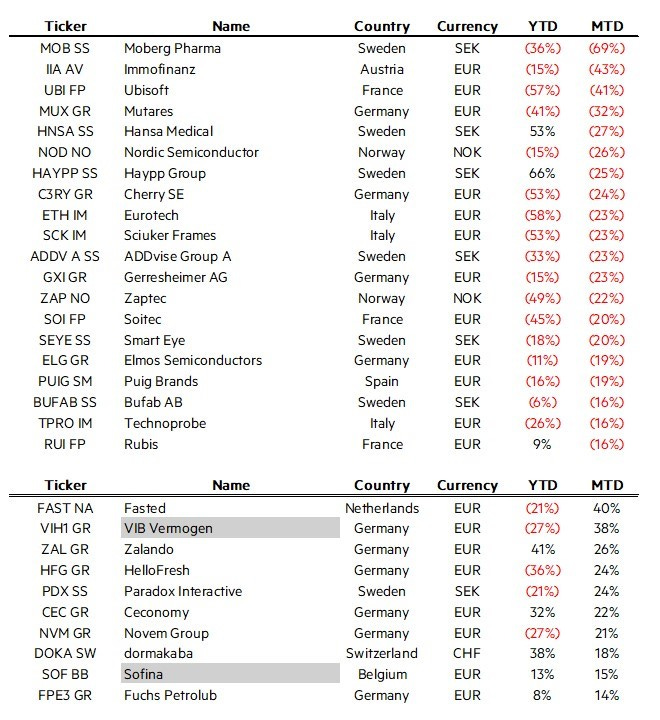

Big movers

Companies in the European SMID space with “big movements” (both up and down) during the month of September that are worth researching further.

Interesting readings

Sunk cost - The rise and fall of NFTs made and unmade OpenSea

Private Credit’s Next Act: Why private credit is tapping into asset-based lending

An Endowment ETF Plans to Ride Wall Street’s Private-Asset Craze

Stock pitches

Short thesis on Mutares ($MUX.DE), a German private equity/holding company that invest in mid-market companies and loosely a competitor to Indus Holding

VusionGroup ($VU.PA): overlooked tech growth story from Europe?

InPost ($INPST.AS): Quick Pitch

Thank you for highlighting the InPost write up 👍