VIB Vermögen ($VIH1.DE) is a small(ish) German real estate company (market cap €300 million) specialised in the development, acquisition and management of commercial properties, in particular in the logistics and light industrial asset classes in southern Germany; in addition, it also manages properties for institutional investors. Founded in 1993, it has been listed since 2005.

Diversified, yet focused

Alongside direct acquisitions, VIB’s broad-based business model also comprises the entire spectrum of development and redensification projects as part of a “develop-or-buy-and-hold” strategy: on the one hand, VIB acquires properties that have been let already, and on the other hand, it develops new properties from the ground up in order to permanently incorporate these into its own portfolio and generate rental income.

VIB’s existing portfolio is thus composed:

In-house portfolio: 81 commercial properties with a total rentable area of ~1 million square meters and a market value of €1 billion. 90% of rentals are from logistics/light industrials clients, with the rest coming from retail and offices, a focus set to be strengthened further.

Institutional business (only launched at the end of 2022): property management on behalf of institutional investors across four funds with a total of 74 properties with 1.15 million sqm of rentable area worth around €1.4 billion. VIB does not invest in these funds, rather it earns service fees (e.g. set-up and transaction fees for the structuring of investments and transfers, and fees for ongoing asset and property management): again, logistics and light industrial properties account for 77% of net rental revenues, followed by retail properties with a share of 23%.

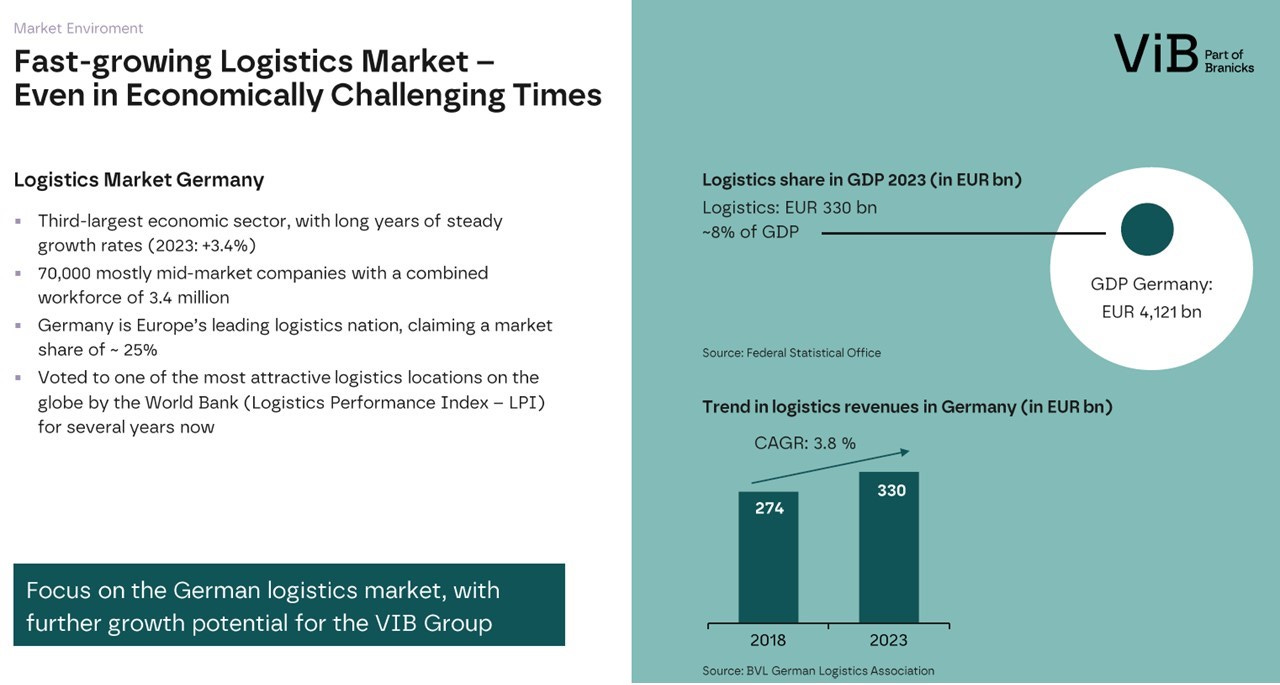

The logistics sector plays a prominent role in the value chain in Germany (especially in Baviera) and has been recording steady growth rates for many years: VIB focuses on German medium-sized commercial tenants and multinationals. A key element of the development strategy is that construction projects only begin once the company has secured binding rental agreements for a significant portion of the property concerned and once financing is securely in place.

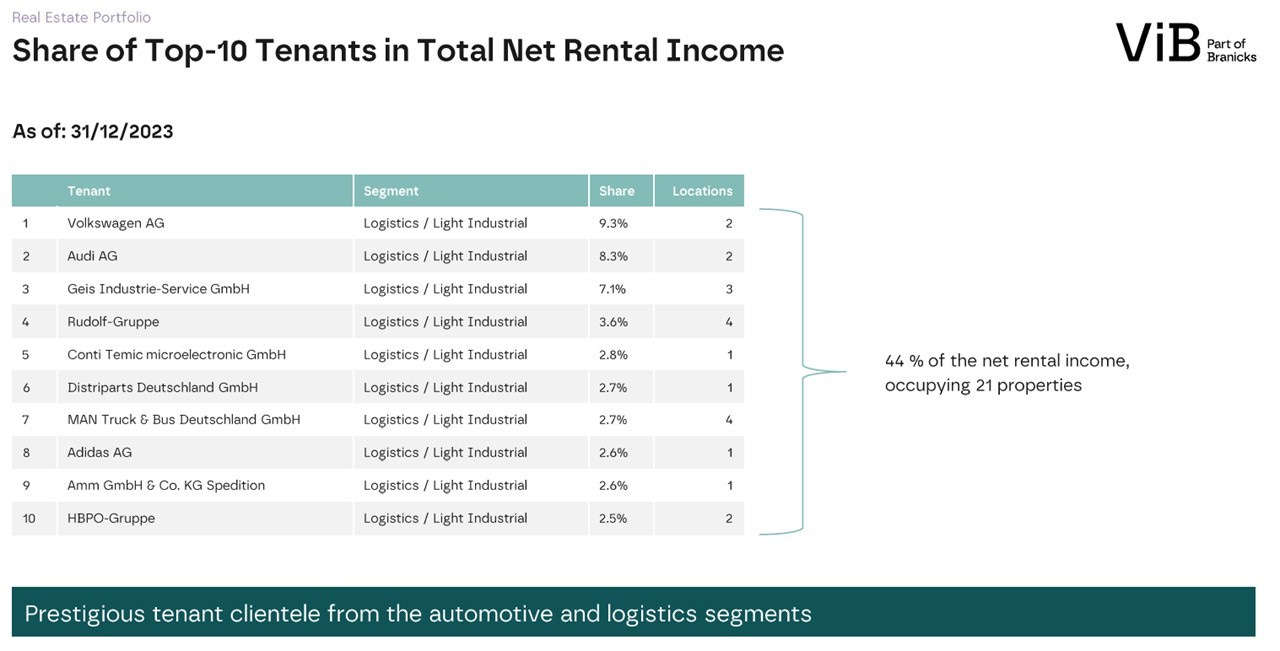

The list of clients is a “Who’s who” of the German industry, mostly in the automotive and logistics sectors and often across multiple properties.

Recent history and some numbers

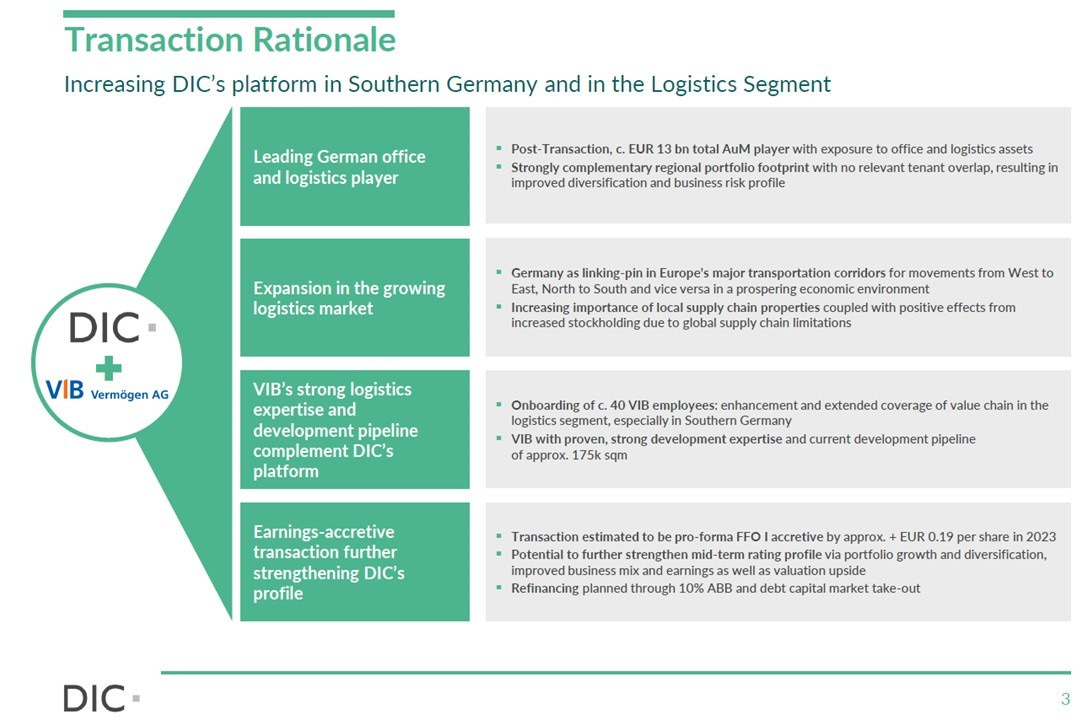

In January 2022, DIC Asset AG (now rebranded Branicks Group and also a specialist in commercial real estate) announced an unsolicited partial offer for a majority stake (51%) in VIB for €51 (DIC already owned ~10% of VIB and was its largest shareholder): the price represented a 94% premium to VIB’s NAV for 2021 but just a 4% premium to the then current market price.