(This is a “new” periodic post where I will discuss updates to ideas previously presented, plus links to interesting readings I found here and there and to remarkable stock ideas provided by other analysts)

Kinepolis

Kinepolis registered a good 2023: visitors and revenues were both up +21%, EBITDAL was up +33% and net profits doubled. However, it’s still 12% below the pre-pandemic number of visitors, despite having roughly 5% more available seats (like-for-like, last year it only had ~75% of the visitors it registered in 2019). The company managed to reduce the debt outstanding, with net debt / EBITDA now sitting at a more comfortable 4.6x.

The stock was up +15% in 2023 but down -14% YTD (also down -8% since the post was initially published): Q1 2024 has indeed been disappointing (visitors and revenues down -10% vs the same period of 2023), with the company blaming it on an (anticipated) weaker film offering.

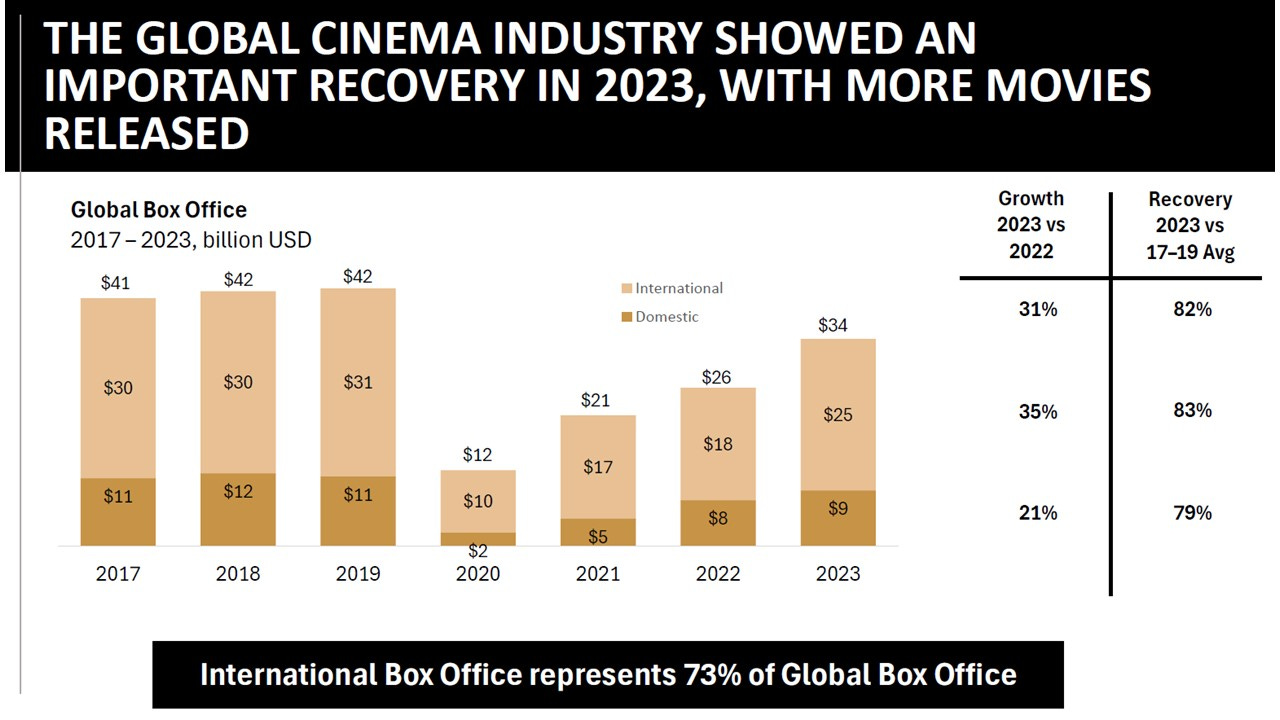

It also held an Analyst Day on April 22 (full deck available here): 2023 was a booming year for the global cinema industry, but the secular trends (discussed in the full post) are still weighting it down from pre-Covid.

Despite the marked improvement in fundamentals, Kinepolis is still trading at EV/EBIT of 17x (much worse in terms of EV/FCF, as maintenance/expansion capex is real) and a P/E of 20x. My comments in the original post was: “a good company, but not exactly an investment that fits my criteria, both for long-term fundamentals and current valuation.” That conclusion still stands.

Siltronic

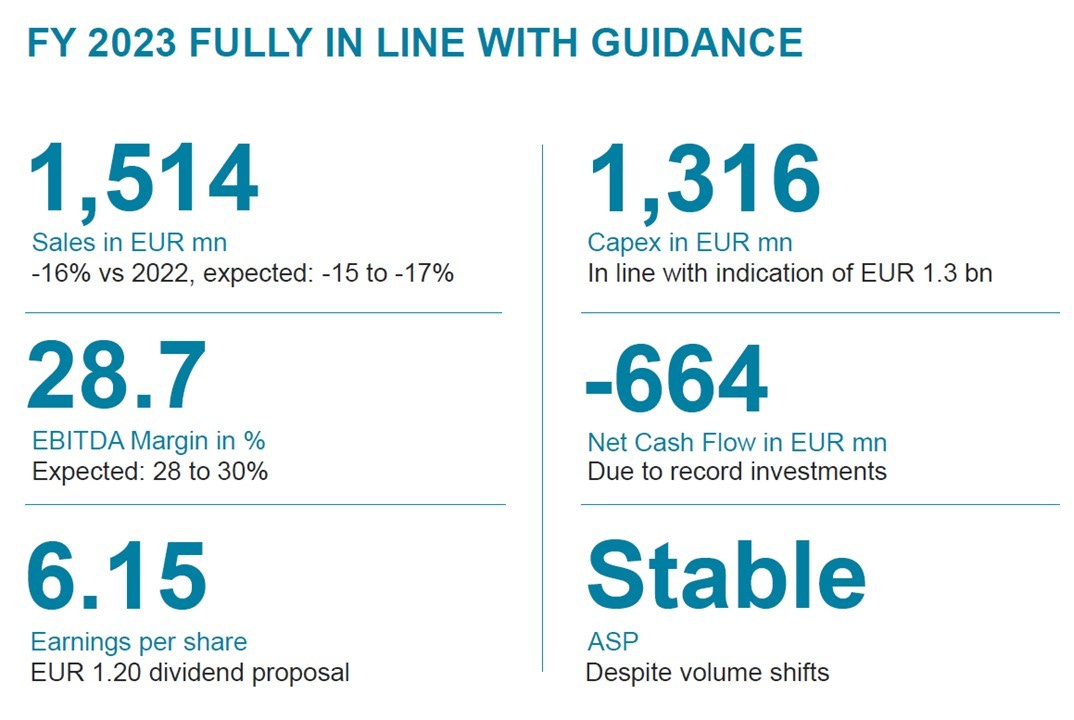

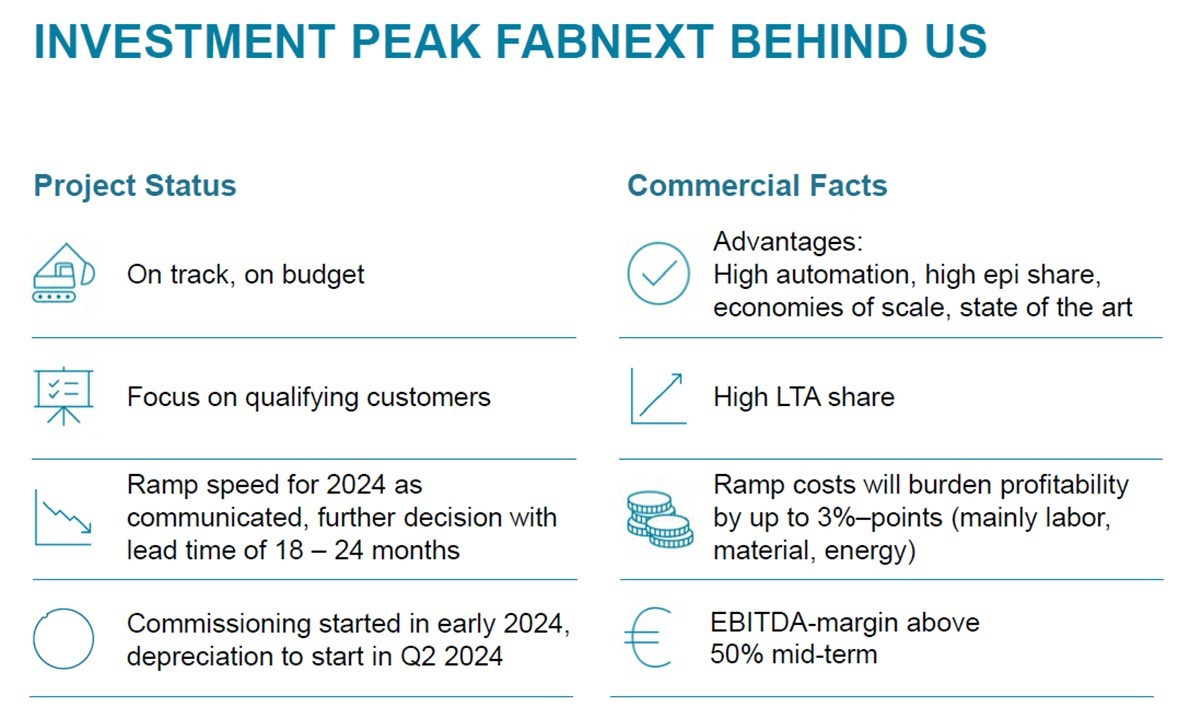

From many points of view, last year for Siltronic can be considered quite negative: revenues were down -16% (from €1.8bn to €1.5bn), operating income more than halved to just €215m, operating margins collapsed to 14% from 20%-25% the previous two years and FCFs turned negative (-€665m) due to record investments. Yet, none of these things were a surprise, and quite very much in line with company’s guidance.

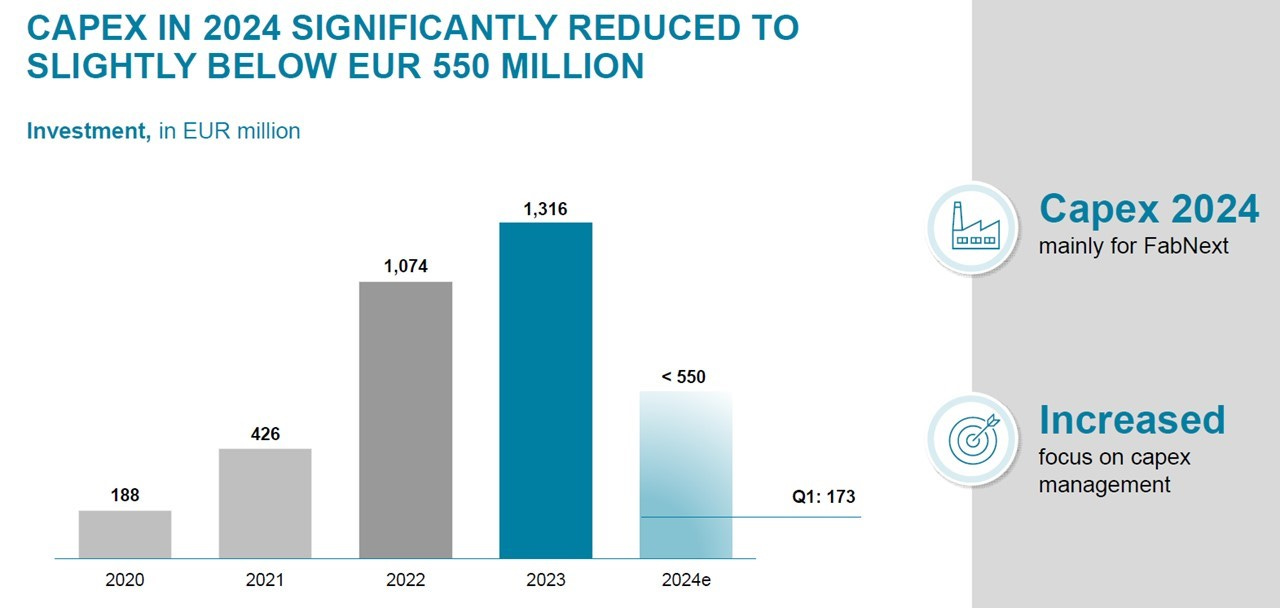

Last year was expected to be a weak market environment vs 2022 for the semiconductor industry, particularly due to high inventories at chip manufacturers and their customers which resulted in a significant decline in demand for wafers. Also highly anticipated was the company’s capex to build a second fab at the Singapore site and expand the one at Freiberg. This turned the net cash position into a net debt position. Most of the expansion is now completed and starting this year capex is expected to return to more “normal” levels.

The stock was up +30% in 2023 but down -18% YTD (and down -8% since the post was initially published), and it’s roughly 50% below the price GlobalWafers offered for the entire company in 2019 (€145: despite Wacker Chemie accepting the offer, the transaction was blocked by the German government). As far as I can tell, neither Wacker Chemie (31%) nor GlobalWafers (14%) have reduced their stake in Siltronic.

Despite stable prices and market share, so far 2024 has continued on a weak demand note (revenues down -4% QoQ), so much that the company is now labelling it “a transition year”.

Interesting readings

Quartr: Microsoft's Journey to Becoming the World's Most Valuable Company

NYT: Tensions Rise in Silicon Valley Over Sales of Start-Up Stocks

Bloomberg: High-Tech Trading Firms Race to Grab Bond Market Turf

Base Hit Investing: Big Tech Capex and Earnings Quality

Also: FT: Data centres have turned Big Tech into big spenders

AQR: Can Machines Time Markets? The Virtue of Complexity in Return Prediction

Bloomberg: How One of the World's Oldest Hedge Funds Went Bankrupt

FT: Starwood’s $10bn property fund taps credit line as investors pull money

Siltronic: what is definitely interesting is our beloved HAL Trust taking a 5.3% stake

https://www.siltronic.com/de/investoren/finanzmeldungen/stimmrechtsmitteilungen/siltronic-ag-veroeffentlichung-gemaess-40-abs-1-wphg-mit-dem-ziel-der-europaweiten-verbreitung-2688081-1705588571.html