This book is just around 200 pages, but definitely worth reading for its lessons!

To be honest, there is nothing in it that I don’t know today (the book was published in 2015), but as the endorsement on the cover says: “I wish I had read 30 years ago!”

The author, Lee Freeman-Shor, is a former fund manager at London-based Old Mutual Global Investors: between 2006 and 2013 he ran the “European Best Ideas Fund” by allocating between US$20 million and US$150 million each to 45 of the world’s best investors, from top European hedge fund managers to Wall Street legends. In running these equity portfolios, he only imposed two conditions: that each manager owned a maximum of 10 stocks at any one time, and that he had complete transparency into each trade and investment that they made.

“The rationale for doing so was the simple belief that the greatest possible returns on capital could be achieved by hiring the best investors in the world and getting them to invest in their best ideas. These were ideas that they had significant confidence in, and were often the result of hundreds of hours of research by some of the smartest people on the planet.”

Over these seven years, the 45 managers made 1,866 investments for a total of 30,874 trades, which are the basis for the book. The conclusions were a surprise to Freeman-Shor (and likely most everyone else): these managers, “the best of the best”, made money on only 49% of their investments, and some had a success rate of just 30%.1

“Given all this, I was sure that I would make a lot of money. It might surprise you, then, to be told that most of their investments lost money.”

“[…] I had employed some of the greatest investment minds on the planet and asked them to invest in only their very best, highest-conviction, moneymaking ideas. And yet the chances of them making money were worse than tossing a coin and betting on heads coming up every time.”

Yet, almost all the managers made money overall.

“What really fascinated me was the fact that, despite some of them only making money on one out of every three investments, overall almost all of them did not lose money. In fact, they still made a lot of it.”

Obviously, this begged the question: “How are they making lots of money if their ideas are wrong most of the time?” Out of this mass of numbers, Freeman-Shor found a pattern: the performance of the managers was largely dictated by what they did AFTER they bought a stock. Though the initial purchasing decisions were important, what mattered most was how these managers dealt with winning and losing positions over time.

“In the process I discovered that successful stock market investing is not about being right per se – far from it. Success in investing is down to how great ideas are executed.”

“Leo Melamed, the pioneer behind financial futures, once said: “I could be wrong 60% of the time and come out a big winner. The key is money management.”

Likewise, George Soros once pointed out that:

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

From his analysis, Freeman-Shor broke down investors into five “tribes” based on how they reacted to winning and losing positions.2 The book is thus divided in two parts:

Part I is “I’m Losing – What Should I Do?”, where we meet the Rabbits, the Assassins and the Hunters. Each of these groups of elite investors found themselves in many losing situations: two of the tribes went on to make a lot of money, one of them didn’t.

Part II is “I’m Winning – What Should I Do?”, where we are introduced to the Raiders and the Connoisseurs.

1. The Rabbits: “Caught in the Capital Impairment”

The Rabbits did nothing when they were losing money: they failed to avoid massive losses and their returns were hurt from it.

“The Rabbits often dug tunnels that were so deep, they never saw the light of day again.”

One of the most important influences on the Rabbits is the “narrative fallacy framing bias”, i.e., allowing their favourite types of investment to dominate how they looked at a stock. For example, one of them invested in Vyke Communications because he loved ‘blue-sky’ stocks and was looking for shares that might be the next big thing.3 Whenever a rabbit found herself in a losing position, the narrative fallacy framing bias tended to kick in and made them think: “Okay, I have lost money – but my thesis, the story as to why I have invested, is not broken. The share price will turn around and I will still make a lot of money from here.” They were capable of constantly adjusting their mental story and time frame so that the stock always looked attractive.

Other common biases for rabbits are:

Primacy error: the way that first impressions have a lasting and disproportional effect on a person (“I’m in love!”). With the Rabbits, first impressions were often everything, and they simply failed to update them to match reality. The net result was that they underreacted when they found themselves losing money.

Anchoring: a closely related cognitive bias, being unwilling to accept new findings that suggest we are wrong.

Endowment bias: when we have a vested interest (we own a stock) we always believe it to be worth more than the price being offered, especially when it’s down as we anchor value to the price we paid. Large losses that happen over a short duration are almost impossible to accept: it’s easier to hold on to a losing position than realise the loss by selling up.

Ego: the Rabbits really don’t like being wrong: they were, in fact, ultimately more interested in being right than making money and were never going to accept that their views were wrong. The fact is, even the greatest minds can be wrong.

Self-attribution bias: we take full credit when things go well but blame others or external factors for our misfortunes. What these investors had in common was the ability to justify their losing positions, no matter what:

“They were capable of constantly adjusting their mental story and time frame so that the stock always looked attractive. […] It never ceased to amaze me how many times the same two villains popped up in the stories told by Rabbits harbouring a losing position: Mr Market (“The market is being stupid”) and his sidekick Mr Unlucky (“It wasn’t my fault, I was unlucky because of XYZ that no one could have foreseen”).”

Here are some of the excuses we have all heard (and used!) over the years:

The ‘If only’ defence: “If only the Fed had lowered rates earlier…”

The ‘Who could have foreseen at the time I invested that XYZ would happen…’ defence (aka ‘ceteris paribus’ defence”): “The stock would have gone up but for the recession!”

The ‘I would have been right but for’ defence: “I was almost right, the euro almost disintegrated in 2011!”

The ‘It just hasn’t happened yet’ defence

“If it’s gone down this much already, it can’t go much lower”

“Eventually they always come back”

“When it rebounds slightly, I’ll sell”

What the Rabbits could have done differently?

Always have a plan: sell or buy more

Don’t go all-in: don’t be hasty to jump in, do be hasty to jump out

Even if you are convinced you are right, remember the saying: “There is nothing like an idea whose time has come.” In investing, a lot of success can be attributed to being in the right place at the right time, otherwise known as luck

Seek out opposition and be humble: the Rabbits, like many investors, were incredibly smart, many of them had MBAs, CFAs and other letters after their name that suggested they had an analytical advantage over the rest of the market. But the Rabbits were also often very confident: they never said, “I don’t know”, a very dangerous mindset to have.

Don’t underestimate the downside – adapt to it: many of the Rabbits loved stocks that had a massive potential upside, they could shoot for the moon if the story played out. Unfortunately, stocks are not options (which have a limited loss, the premium paid), they do have a downside, and it can be large.

2. The Assassins: “The Art of Killing Losses”

Some of the statistics quoted in the book show that when stocks go down a lot, most never come back: that makes staying pat with a losing position a bad idea, so it’s better to take action, by either cutting the position, or increasing it.

When it comes to selling losing positions so as to preserve their capital, the Assassins are ruthless, pulling the trigger without emotion: they clearly understood that drawdowns left to their own devices are ultimately what destroys wealth.

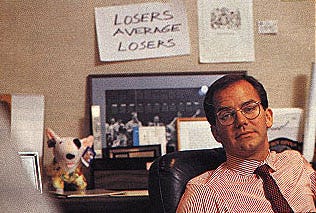

Paul Tudor Jones is famous for this picture:

while Stanley Druckenmiller said:

“(Soros is) the best loss taker I have seen. He doesn’t care whether he wins or loses on a trade. If a trade doesn’t work, he’s confident enough about his ability to win on other trades that he can easily walk away from the position.”

The Assassins understood that successful investing is about ensuring that the upside return potential is significantly greater than the downside potential loss.

The best Assassins follow a “code” made up of two main rules:

Kill all losers (most at 20%-33%): in a losing trade, the temptation to wait is overwhelming, therefore the Assassins did not rely on themselves to pull the trigger but rather their weapons went off automatically at exactly the right time, taking out their targets without delay.4

Kill losers after a fixed amount of time (six months was the average): the reasoning behind this second rule is best summed up by the old axiom: “Time is money”. Being in a losing position too long – even if the size of that loss hasn’t hit 20% or more – can have a devastating effect on your wealth.

3. The Hunters: “Pursuing Losing Shares”

Like the Assassins, the main reason for the Hunters’ success was what they did when they found themselves in a losing situation. But unlike the Assassins, they did not sell out of those positions: they bought significantly more shares. Rather than killing an underperforming investment and forgetting about it, they stalked their prey: watching it get steadily weaker and lassooing another limb every time it stumbled. Then they sat back with their prize and waited for it to recover, eventually selling it on for a handsome profit.

In gambling, such behaviour (“doubling down”) is known as the martingale approach: it is frowned upon and rightly so, because it often leads to ruin. But the stock market is not a casino (although many do see it like one): in well-chosen investments this is a strategy that wins over time, as you acquire more and more assets at cheaper and cheaper prices. When the price of the assets goes up above the average price you have spent, even if it is hardly motoring into new highs, you will be making money.

This strategy obviously requires that you are right on the company, but more important successful practitioners of what is called ‘dollar-cost averaging’ planned beforehand to buy more shares if a price fell. They never went go all-in on day one: rather, they invested a lesser amount at the outset and kept some cash on the side, waiting for an opportunity to buy more at a lower price in the future. Some even had preset rules for new positions, buying one third of the amount for an initial position, one third of the amount if the price fell to a certain limit, and one third if it fell further.

The key reason for the Hunters’ approach lay in their invariably contrarian style: they are value investors. They generally found themselves buying when everyone else was selling, another way of exploiting Mr Market when he was acting irrationally.

4. The Raiders: “Snatching at Treasure”

Raiders occupy a thin line between success and disaster: these are investors who like nothing better than taking a profit as soon as practical.

“They are the stock market equivalent of golden-age adventurers: having penetrated through the dense jungle, found the lost temple or buried treasure, they fill their pockets with all the ancient coins and gems they can – then turn tail and run.”

The Raiders often sell positions too early for a small profit, thus missing out on larger gains. They do it because they are terrified of getting caught in a reversal and losing everything (the pain of a short-term loss overpowers the pleasure of a long-term gain), and to ensure they at least come away with something.5

“I discovered the Raiders when I noticed the rather distressing fact that one of my investors had an incredible success rate – almost 70% of his ideas were correct, which is truly phenomenal – but he hadn’t made me any money. He and the other Raiders lacked a key habit that the successful investors I worked with possessed. He did not embrace the right tail of the distribution curve. In ordinary terms, the Raiders did not run their winners.”

Selling for early gains also mean that you have to constantly find alternative investments or sit unproductively in cash. Raiders had a high success rate with their investments but failed to make much money because their gains were too small, and a large loss often wiped out those small gains.

“Stock market returns over time show kurtosis, which means fat tails are larger than would be expected from a normal distribution curve. This means that a few big winners and losers distort the overall market return – and an investor’s return. If you are not invested in those big winners your returns are drastically reduced.”

It might seem an enviable position to be in as you are locking in profits (“Look, 70% of my trades are profitable!”), but the best course is not to be a Raider.

“Raiders are often Rabbits when they’re losing – and the combination is fatal. If you combine the urge to sell winners too soon with the reluctance to sell losers, the net result is losing a lot more than you win: you have effectively got an investment style that combines significant downside risk with insignificant upside potential.”

5. The Connoisseurs: “Enjoying Every Last Drop”

The Connoisseurs are the last and most successful investment tribe: they do not get paralysed by unexpected losses or carried away with victories.

The Connoisseurs let their winners run. And very interestingly, they had a lower success rate than the other tribes, but their winners won big, and made enough to cover the losers, and then some.

“Many of the Connoisseurs I worked with came across as cerebral, and if you met some you might easily think they became rich by being prodigious thinkers with IQs off the charts. Don’t be fooled. In terms of hit rate, as a group they actually had a worse record than the average for my investors. Six out of ten ideas the Connoisseurs invested in lost money. The trick was that when they won, they won big. They rode their winners far beyond most people’s comfort zone.”

Again, the key to their success is that they have a well-defined process which helped them with winning positions: they were either quick to sell losers or comfortable adding to positions at lower prices which ended up being winners.6

Here’s how to be like a Connoisseur:

Find unsurprising companies: as earnings/FCFs drive stock prices, find companies whose future growth of earnings is very predictable, and the stock price should therefore drift higher over time. (Yes, this is essentially Buffett/Munger). The main risk of buying these stocks is if they were rated highly at the outset: this could mean that the company fundamentally performs as expected but the share price doesn’t follow earnings upwards due to it getting derated.

Look for big upside potential: if the average success of an investment idea is ~50% (and that’s the average for some of the very best investors in the world!) it really does matter that when you win, you win big. Where many investors go wrong is in investing in too many ideas with limited upside potential or cutting it off after a small gain (of, say, 10% - 30%), like the Raiders do. This can sometimes be the result of self-imposed artificial constraints: one of the secrets of the Connoisseurs is to never use price targets.

Invest big – and focused: when the Connoisseurs are very confident in an idea, they build up big positions, including ending up with 50% of their total assets invested in just two stocks.

Don’t be scared: one of the keys to riding a big winner is to avoid being scared out of it, for example by taking small profits as the stock kept going up rather than selling entirely out of the position.

Make sure you have a pillow: one of the key requirements of staying invested in a big winner is to have (or cultivate) a high boredom threshold.

“Meeting some of my Connoisseurs could be very, very boring because nothing ever changed. They would talk about the same stocks they had been invested in for the past five years or longer. […] The fact is, most of us will find it difficult to emulate the Connoisseurs because we feel the need to do something when we get to the office (or home trading desk) every day. We look at stock price charts, listen to the latest market news on Bloomberg TV, and fool ourselves into believing we could add value from making a few small trades here and there. It is very hard to do nothing but focus on the same handful of companies every year, only researching new ideas on the side. Many of us, seeing we have made a profit of 40% in one of our stocks, start actively looking for another company to invest the money into – instead of leaving it invested. This is precisely why lots of investors never become very successful.”

Unfortunately, many fund managers find it almost impossible to be Connoisseurs, and it’s not just their fault. Firstly, many professional investors over-diversify because they are managing their career risk: most are judged by their bosses AND clients based on how they perform against an index or peer group over a short period of time. This militates against concentrating investments in potential long-term winners.

Secondly, regulators – based on investment theories from the 1970s – have put into place rules that prohibit professional fund managers from holding large positions in just a handful of their very best money-making ideas, because they believe diversified portfolios represent less risk than a concentrated portfolio of stocks. The reality, however, is that all you are doing is swapping one type of risk for another: you are exchanging company specific risk (idiosyncratic risk), which may be very low depending on the type of company you invest in, for market risk (systematic risk). Risk hasn’t been reduced, it has just been transferred.

Some conclusions (by the author): the habits of success

Freeman-Shor distilled his study into what he termed the habits of success, the five winning traits of investment titans:

Best ideas only

Position size matters

Be greedy when winning

Materially adapt when you are losing

Only invest in liquid stocks

On the other hand, the five losing habits included:

Invest in lots of ideas

Invest a small amount in each idea

Take small profits

Stay in an investment idea and refuse to adapt when losing

Do not consider liquidity

The success enjoyed by top investors (at least the ones profiled in the book) is not due to possessing a special gift, though many are indeed very smart. Instead, success ultimately came down to just one thing: execution.

Also, while these 45 investors are divided into tribes, none of them self-identified as belonging to any specific group when it came down to execution. It was all habit, just what they do.

“These habits meant they did not need to possess a gift that enabled them to buy or sell shares at the right time. They did not need clairvoyant forecasting abilities. The hidden habits meant they knew what to do when they found themselves in a losing situation, and likewise what to do when they found themselves in a winning situation.”

“If they were losing they knew they had to materially adapt, like a poker player being dealt a poor hand. A losing position was feedback from the market showing them that they were wrong to invest when they did. They knew that doing nothing, or a little, was futile. They had each independently developed a habit of significantly reducing or materially buying more shares when they were losing.”

“When winning, to take an analogy from baseball, the successful investors knew they had to try to hit a home run, as opposed to stealing first base. This meant that they had developed the hidden habit of being resolved to stay invested in a winning position even when inside they were burning to take the profits they had made, and their inner voice was screaming, “Take the profit before you lose it!””

Going back to the dinner mentioned in footnote 1, one of the things that struck the author that night was the arguments: around the table sat a motley crew of Connoisseurs, Hunters and Assassins – all leading investors of the very highest calibre – and yet you would struggle to find so many contradictory views among so few people debating the merits of an investment, one of them telling the other that he is insane to even consider the merits of a stock.

“You might reasonably assume that one would be a winner and the other a loser; after all, the market is a zero-sum game. Not so. All were successful despite having different and conflicting views about what to invest in, because they all shared the same habits. They had all mastered the art of executing their ideas.”

More considerations (this time by me)

It seems easy to “choose” which type of investors we should be: we all want to be Connoisseurs, when we are winning, and Assassins when we are losing (or even better Hunters if we are then right). No one wants to be a Rabbit: first, you were wrong in identifying the stock, and then you were even more wrong by holding onto it when it kept going down. Most people will likely be happy to be Raiders (and this is indeed what most retail day traders aspire to be), but longer term it’s not a profitable attitude.

Fact is, we can’t simply decide “I want to be a XXX”: even after studying all the best investment strategies and knowing all behavioural biases, we are still prone to succumb to them, and that’s what makes financial markets both complex and adaptive. For example, be under no illusions: being a Hunter requires patience and discipline. You have to expect a share price to go against you in the near term and not panic when it does. You have to be prepared to make money from stocks that may never recapture the original price you paid for your first lot of shares. If you know your personality is one which demands instant gratification, this approach is not for you.

"If you don't know who you are, the stock market is an expensive place to find out." (George Goodman - aka Adam Smith)

I know, for example, that I’m not built to be an Assassin (I almost never use stop losses): I hope to be a Hunter, but I do end up as a Rabbit once in a while.

Successful investors want you to think that success in investing is beyond the abilities of the average person. They want you to believe that returns are driven by managers and teams possessing special gifts. This is propaganda.

Success in investing is open to anyone, whatever their level of education or background, whether old or young, experienced or inexperienced. You simply need to materially adapt when losing and remain faithful when winning.

While many factors cause stock prices to rise and fall, the ultimate determinant of whether you will make or lose money is your actions. Having an investment plan is fine, but how you execute it is more important.

If you have the discipline to do that, you can succeed.

“Everyone has a plan until they get punched in the face” (Mike Tyson)

Lee Freeman-Shor: “The Art of Execution: How the World's Best Investors Get It Wrong and Still Make Millions”

None of the 45 managers is ever named in the book: I will use “he” or “she” interchangeably but have no idea of who they are. The only one that is mentioned is the most high-profile, the billionaire hedge fund manager Crispin Odey (now disgraced for sexual harassment), who hosted a dinner in London for some of these investors.

Each manager was hired individually, but the data revealed that there were obvious behavioural groupings among them.

Vyke was a UK-based company that specialised in software that allowed users to make telephone calls and send text messages over the internet using their mobile phones, computers or normal landlines. The investor bought shares in 2007 at £2.10, essentially its peak price, and when the stock started to fall shortly after his initial purchase he bought more. As it kept falling, the investor chose to stay invested but refused to put more money to work. She decided to sell her entire position in 2010 with the stock down 99% and trading at £0.02. By 2011 the stock was delisted: the investor was lucky to get out at all.

Stop-losses are a common practice in trading but less so in investing (and it is no coincidence that a number of the Assassins were hedge fund managers). Most investors use ‘review’ prices instead – if one is hit, it forces a review of the holding to decide what to do. In theory this sounds good: the review is designed to wake us up and force us to take action, the problem, however, is that too often we do nothing. On the other hand, it can be very tempting to take assassination to extremes and start cutting losses dead at 5%-10%: why not despatch the unhappy victims as soon as possible? It’s important to realise that the Assassins’ rules did not just protect them from indecision – but from overreaction too: very often we end up selling too early just because of market volatility, and would-be Assassins are exiled from the gang for overeagerness.

According to a study by professors Brad Barber and Terrance Odean (‘Online Investors: Do the Slow Die First?, EFA, 1999), this problem has grown thanks to the unprecedented immediacy of the Internet. They discovered that people who traded via telephone from 1991 to 1996 outperformed the market by 2.4% per year on average; however, when they changed to trading online they underperformed the market by 3.5% per year. I wonder what the results would be today with Robinhood, meme stocks, YOLO, zero day to expire options, …

In other words, every Connoisseur is also an Assassin or a Hunter when it came to losses.

Execution distinguishes the winners from the losers, not the stock-picking skills.

One of the best books on investing.