Clarkson plc

Asset-light compounder currently tangled in the tariffs’ uncertainty

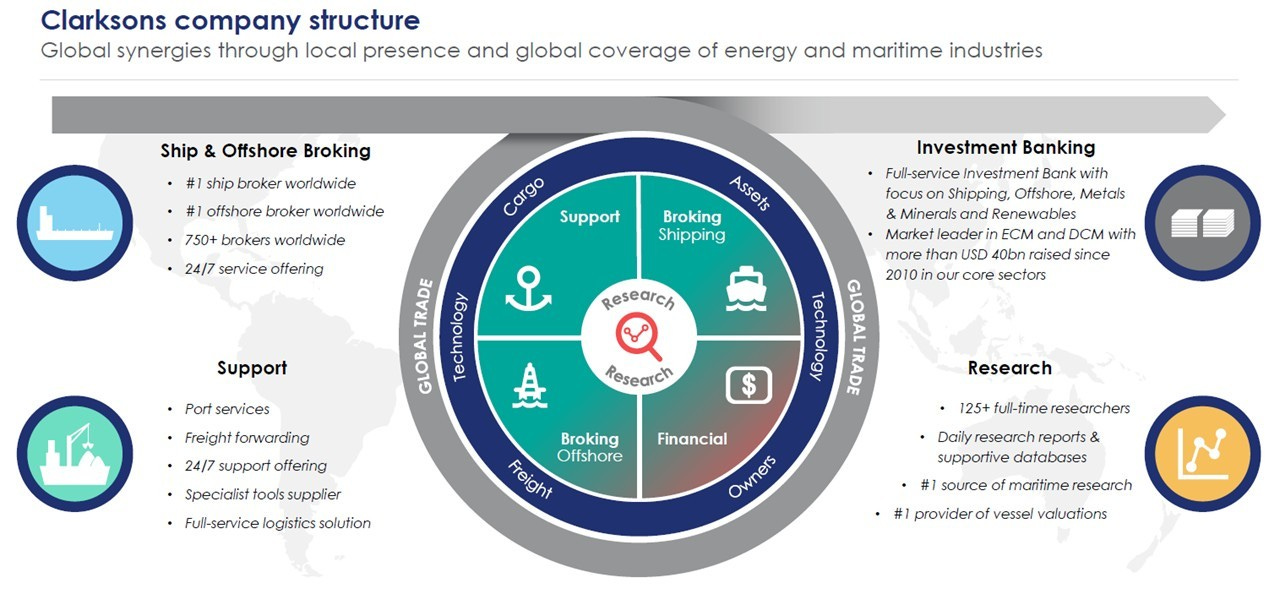

Clarkson ($CKN.L) is a £1 billion British shipping broker that provides integrated services and investment banking capabilities to the global maritime and offshore industries.

Founded in London by Horace Anderton Clarkson in 1852, the company focused almost exclusively on the ship brokerage business throughout its 173-year history1: its principal business is arranging contracts between buyers and sellers (or lessees and lessors) of a variety of ships and equipment. As a broker, it simply collects a fee based on the value of the transaction.

The share capital is entirely free float, with the biggest shareholders being Lindsell Train, Royal London Asset Management and Fidelity (all at ~5%), followed by RS Platou Holding AS (~4%). Andi Case (CEO since 2008) owns ~2% and Jeff Woyda (CFO since 2006) owns ~0.5%.2

Activities & value drivers

Clarkson is the world’s leading provider of professional maritime support services, with a range of complementary services alongside the core areas of activity.

According to Lloyd’s List (the industry bible), it is by far the world’s #1, the “undisputed heavyweight of the shipbroking market”. The #2 company, Braemar plc, is also London-listed but Clarkson’s revenues are 4.5x larger (£660 million vs £150 million), and its market cap is 13x. The other eight of the top 10 shipbrokers are privately held or subsidiaries of diversified groups and have revenues of between £15m and £30m per annum.

Clarkson operates through 4 business segments:

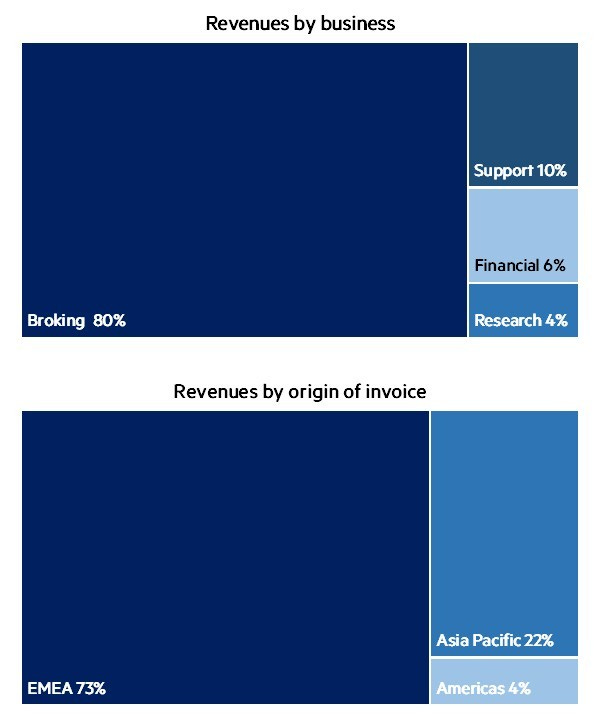

Broking (80% of revenues): an intermediary between shippers (cargo holders) and carriers (shipping companies) in all major global markets (60 offices in 24 countries with over 1,400 employees) to negotiate the terms of a voyage, a time charter hire or a contract of affreightment. Chartering is a complex process of matching the appropriate vessel at the right time for a particular voyage, and there are many other elements to fix in the agreement, from insurance to crew and fuelling. Clarkson also helps clients contract new buildings, buy and sell second-hand vessels, and arrange the scrapping of older tonnage. For all these activities, it earns a commission based on the value of the freight, the hire or the asset: for most charters, a typical commission is 1%-1.25% and unlike in many other broking businesses, shipping commission rates have been remarkably stable over time

Financial (6% of revenues): full investment banking services (M&A, restructuring, risk management, equity and bond issuance, valuations, project finance) and bespoke asset finance solutions to the shipping, offshore and natural resources markets

Support (10% of revenues): the highest standards of support to the marine and offshore industries with 24/7 attendance at strategically located ports (UK, mainland Europe and Africa), with services that include port agency, project logistics, freight forwarding, helicopter operations, warehousing, crew travel and industrial supplies

Research (4% of revenues): the market leader in providing authoritative, subscription-based intelligence on all aspects of shipping: millions of data points (140,000 vessels, 25,000 machinery models, 40,000 companies, and 600 shipyards) are processed and analysed every day for internal use and external clients: subscribers include all major Wall Street investment banks3