Macro post – Soft landing, sure, but will rates go as low as markets imply?

“Too much optimism is already priced in!”

As already pointed out in the discussion about China, I’m not a macro investor and I don’t look at forecasts for GDP growth or the level of interest rates when analysing companies: if a company is attractive when rates are at 1% but not so much if they rise to 5%, then it’s probably not a good investment.

However, I’m fully aware of the role of interest rates in financial markets:

“Interest rates are to asset prices like gravity is to the apple.” (Warren Buffett)

So it’s always good to check what’s going on and – more important – how markets are pricing it.

[The discussion is mostly focused on the US as everyone expects the Fed to cut rates at its next meeting on September 18, although the ECB could be first by doing the same on September 12. All charts below are courtesy of Minack Advisors unless stated.]

A soft landing, but that won’t make risk assets attractive investments

There are several reasons to believe that the likely outcome for the US economy is a soft – not hard - landing.

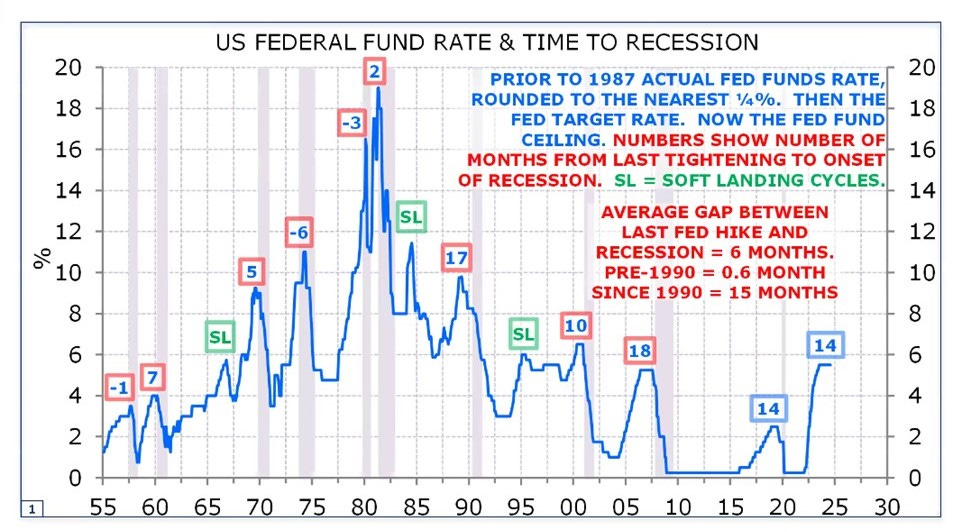

It is true that when the Federal Reserve hikes interest rates, the economy ends up in a recession: post-WWII, that happened in 3 out of 4 tightening cycles. The average gap between the hike and the start of a recession is 6 months, but with two very different regimes: pre-1990 the gap was not even a month (hike —> immediate recession), since 1990 the gap has lengthened to 15 months!