Monthly recap #10

An update on two previously discussed companies, and more interesting things from June

Société BIC

First discussed two and half years ago, the main conclusion from the analysis was that BIC was a “cigar-butt”, with most segments in secular decline but with maybe a last puff left:

“It's probably a better stock to trade rather than own, especially if it should trade down to €50 (from the current mid-€60s level).”

Within few months the stock did trade down to €51, followed however by a quick recovery to €70 by June 2024, and today it’s back again to the low-€50s: an astute trader (and I’m not…) could have made some good money.

At the moment, nothing seems to be going right for the company (stock is down 17% YTD):

grappling with weak sales (70% of operating profits still coming from lighters,): it issued a profit warning for Q1 2025, with revenues down -7% YoY, and guidance lowered to growth of 0%-3% from 4%-6% previously for the entire year

highly vulnerable to tariffs: ~37% of revenues are from North America

unexpected churn at the top: in mid-June the company announced that both the Chairman and the CEO will be replaced in September, and a week later the CFO also stepped down

risk of frictions between the controlling Bich family (63% voting rights) and the new shareholder Olivier Goudet (5% voting rights)

Q3 & Q4 2024 were encouraging, with sequential improvements in comparative sales, but Q1 2025 was very bad and Q2 will be (at best) flat with little hope of a recovery in H2 2025: North America remains problematic, with notable trade-downs mainly seen in lighters and the stationary business. Add the tariffs to complicate the matter further: only half of the lighters are manufactured in the US, with the remaining being imported from Europe; shavers are in an even worse position, with most products sold in the US manufactured in Greece (BIC’s competitors have much higher local production).

On the brighter side, BIC has been able to maintain (and even grow) market share in other regions, mostly thanks to the continued focus on innovation and the execution of the 5-year “horizon strategic plan” (operating efficiencies, ~40% reduction in SKU vs 2019, …).

The change of guard at the top should be net positive, as the stock performance since Gonzalve Bich (the outgoing CEO) took over in November 2018 has been negative. Anyway, the Bich family is still in control of the board, with Edouard Bich becoming Chairman and the family holding 6 out of 10 seats.

The new CEO Rob Versloot has more than 30 years’ experience in consumer goods companies (Danone, Hero Group), including driving complex transformations for sustainable growth. But what can he really do? And turning the ship around will require at least 6-9 months, so we are talking Q2 2026 results. Olivier Goudet is also an experienced consumer goods veteran, particularly for his leadership roles at JAB: his recent investment in BIC was mainly executed via total return swap contracts with a June 2026 expiry date at a price of ~€59 (so currently out of the money), aligning his horizon to a 12 months turnaround.

The current share price does not seem to factor in any potential upside from the restructuring: the stock is currently trading at EV/EBIT 7x, P/E 10x and FCF yield 11% on 2025 expected numbers (although the €240 million in expected FCF – vs €270 million in 2024 – might be optimistic given the current sales trends), for a company that is still generating a ~15% ROIC with a net cash position.

All considered, it might be worth a small bet on the CEO’s ability to delivers results quickly (probably also Mr. Goudet’s hope). Last but not least, the controlling family might be willing to consider splitting the company, considered the limited synergies among the three segments.

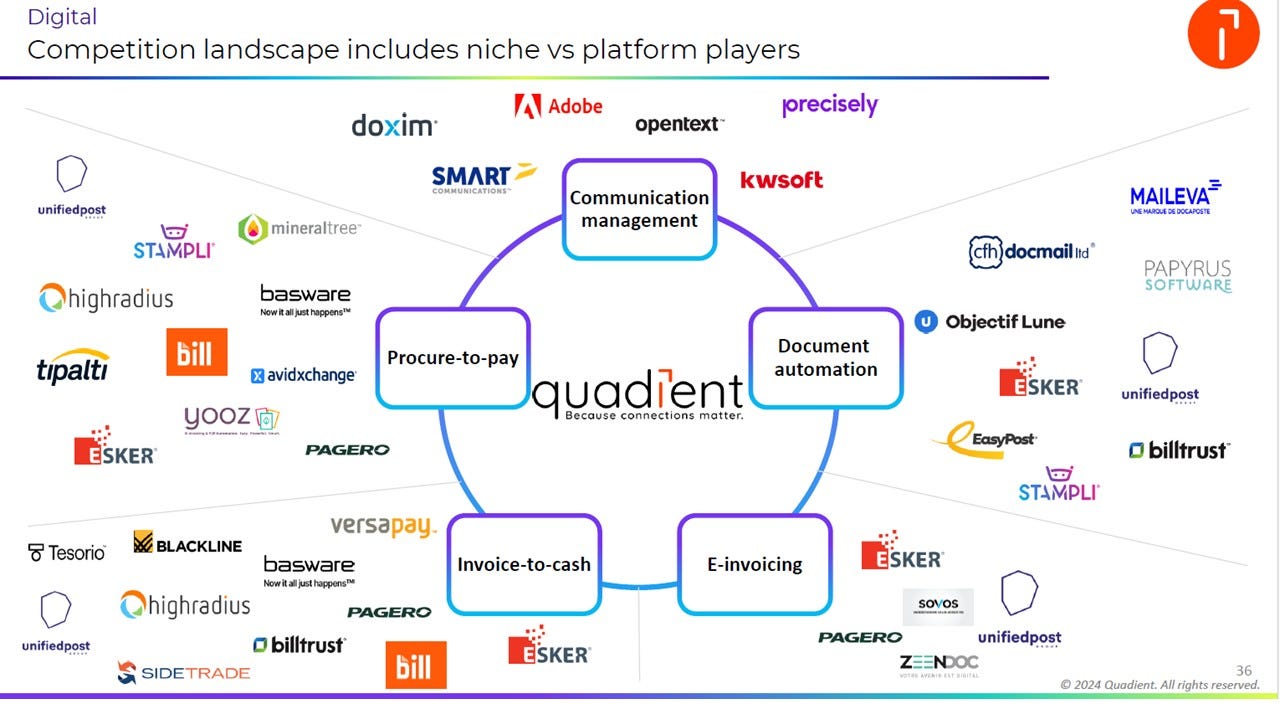

Quadient

A more recent deep dive from July 2024, Quadient (formerly Neopost) is another French company in a similar situation: with a core business in secular decline (in this case hardware for preparing and sending out mail), it’s trying to reinvent itself into more “modern” operations (software/digital communication and a network of lockers for parcel delivery).

While sceptical of business transformations (especially on a 7-year horizon…), my “back-of-the-envelop” SOTP valuation pointed to a €30 intrinsic value (vs €19 at the time of writing and €16 today): not exactly a prescient valuation (at least so far), although I warned:

“Not a slum-dunk: for anyone willing to bet on Quadient, patience is required.”

Today, the mail segment is the shrinking cash cow (revenues expected to decline at -3% CAGR, high EBITDA margins also contracting from ~30% to 25%), while software is the diversification arm (current low profitability but increasing rapidly) and lockers what the longs believe to be the hidden value (growing fast, still unprofitable but with 15% operating margins on installed basis).

The “wild card catalyst” remains the presence of Daniel Křetínský as a major shareholder (from 15% a year ago he is now at 23%):1 he wants to create a European leader in logistics/distribution with stakes in PostNL, RoyalMail / International Distribution Services and FNAC Darty. He may push for a sale of the entire company or some sort of M&A with another European player. Management has also indicated that there are no qualms in selling individual divisions or letting minority shareholders in.

Business-wise, not much has changed since the first discussion of the company (performance is -12%, with 3% coming from dividends). On a multiples basis, QDT is as cheap as (if not cheaper than) BIC: EV/EBIT 9x, P/E 7x (but with higher debt: net debt/EBITDA is 3x – although lease receivables distort both debt and ROIC calculations).

Chart of the month

According to the Global Innovation Index, Switzerland and Sweden are more innovative than the US, and UK, Finland, Netherlands, Germany and Denmark are not that far behind (China is #11, France #12, Japan #13). These countries should prove fertile grounds for stock-picker interested in long-term growth oriented startegies.

Paper of the month

Morningstar did a study on “Consolidation in the European Asset Management Industry”, with the poignant subtitle “The Elusive Benefits of Scale”:

“That said, the benefits of consolidation touted by dealmakers are often hard to realize in practice, with various stakeholders - shareholders, clients, and employees - potentially experiencing different outcomes from the same transaction, as consolidation presents five critical integration challenges: cultural misalignment, leadership complexity, talent exodus, product rationalization risks, and scale disadvantages that may compromise performance.”

In particular, Morningstar found out that:

European asset managers still prioritise organic growth over acquisitions: most firms do not rely on M&A at all, or max 1 deal; less than 30% use M&A as the principal growth strategy and even less do it only occasionally

Most M&A activity still consists of smaller bolt-on transactions: larger transformative deals are rare

Main reason to use M&A: to achieve economies of scale + access to new markets and client segments without the lengthy process of organic development

Strong allure for a mature industry (i.e., a quick solution to the challenge of declining fees), but execution is tricky: bigger is not always better and economies of scale are feeble

Fee pressure + increase in other costs (technology, compliance, …) mean cost/income ratio actually increased (or at best were stable) even in the three big mergers (Amundi/Pioneer, Janus/Henderson, Standard Life/Aberdeen)

And only Amundi consistently booked inflows post-merger: both Janus Henderson and Aberdeen experienced significant, sustained outflows following their mergers

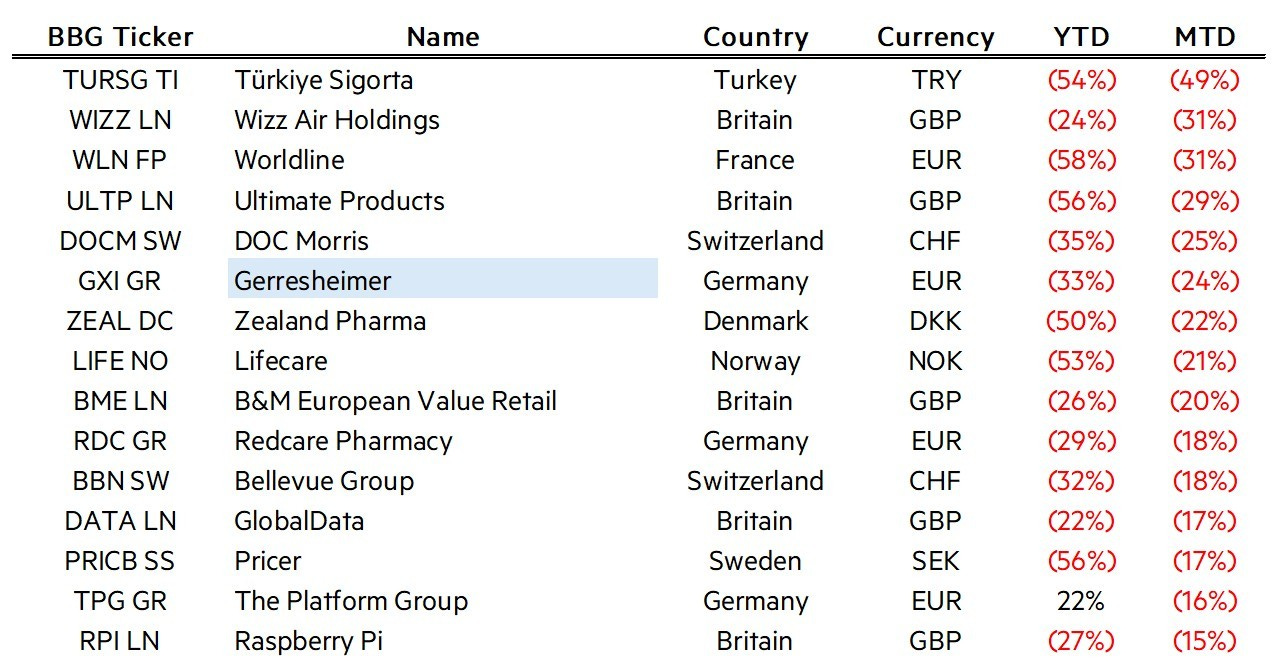

Big movers

Companies in the European SMID space that were down significantly during the month of June but could be worth researching further.

Interesting readings

For Goldman Sachs, Europe is Shangri-La for stock pickers: “Road to Renewal: Investing in a New Era for Europe”

Also from GS, the current environment is more conducive for alpha generation, making hedge fund returns more valuable today: “Mapping the Evolution: Hedge Funds in A New Market Regime”

Industry insights

AI’s dropping cost of intelligence | Agentic AI | Batteries | Beauty | Critical minerals | Dating Apps |

But Teleios is now out of the stock