[Not a deep dive on fundamentals and unit economics, rather a shorter note on a company with a potential catalyst. I will be experimenting with these “shorter” format write-ups - along longer analysis on “under-researched” companies - to see how it works.]

SoftwareONE ($SWON.SW) is a €2.2 billion Switzerland-based IT services company, specialising in selling end-to-end software and cloud technology solutions to SME customers: a global Value Added Reseller (VAR) not too dissimilar from Mensch und Maschine.

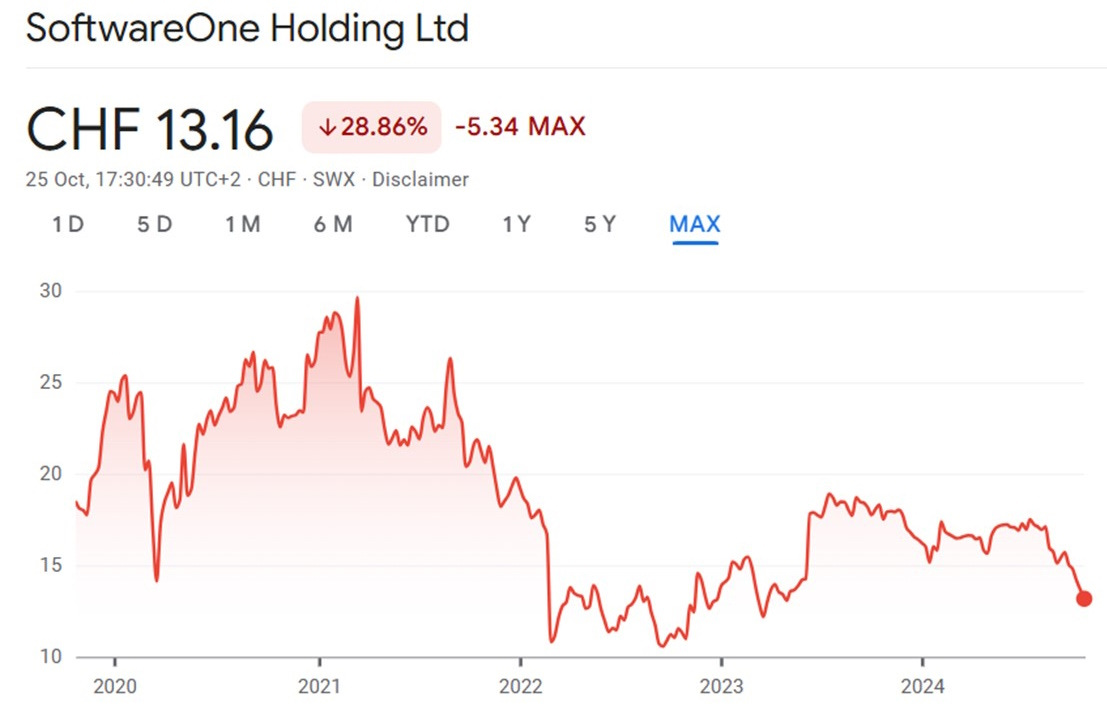

SWON was IPOed in late 2019 at CHF 20 per share but has had a troubled history as a public company, having failed to deliver on some key financial promises that management made at the time of the IPO, for example downgrading EBITDA margin guidance from “approaching 35%” to “above 25%”.1 The market did not take these disappointments lightly, and the share price is down around 35% from the IPO price and 55% from its peak in 2021.

SWON’s business

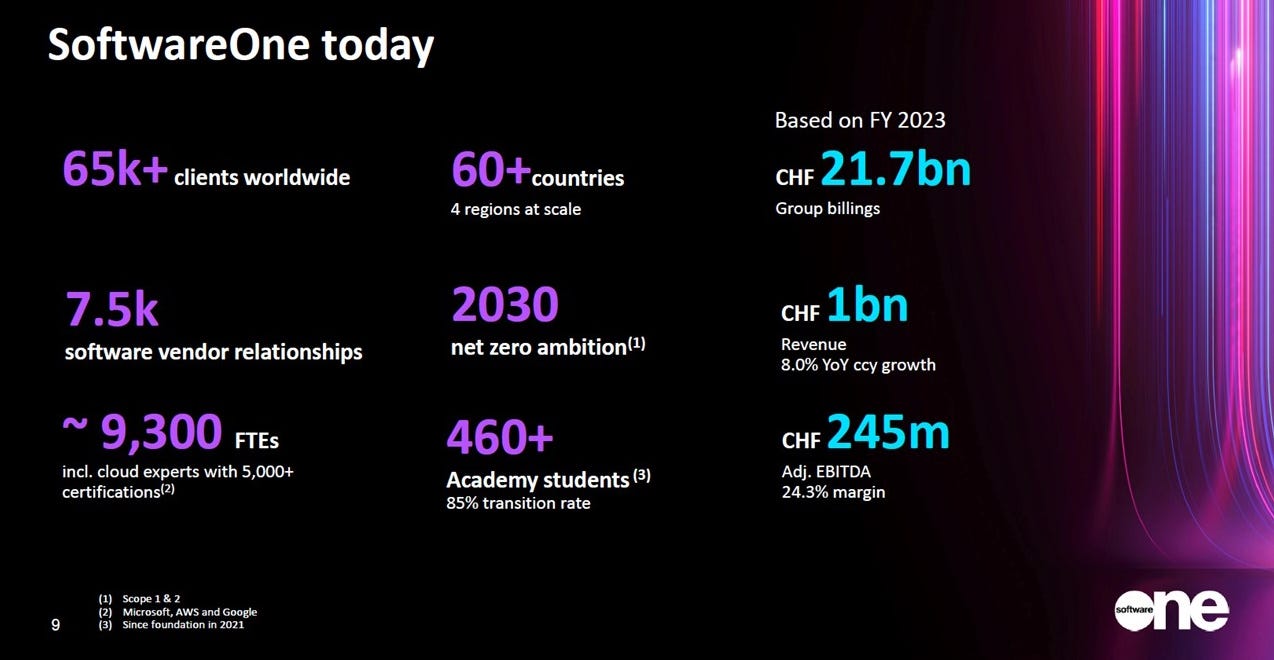

SoftwareONE provides comprehensive software management services to 65k+ business customers across 60+ countries through two divisions: Software & Cloud Marketplace (“S&CM”, ~55% of net revenues in 2023) and Solutions & Cloud Services (“S&CS”, ~45%). Revenues are skewed heavily to EMEA (62% of total), with the rest in US/Canada (14%), Asia-Pacific (14%) and Latin America (9%). The business is 100% software and 0% hardware.