Bi-weekly recap #3

Grupo Catalana Occidente

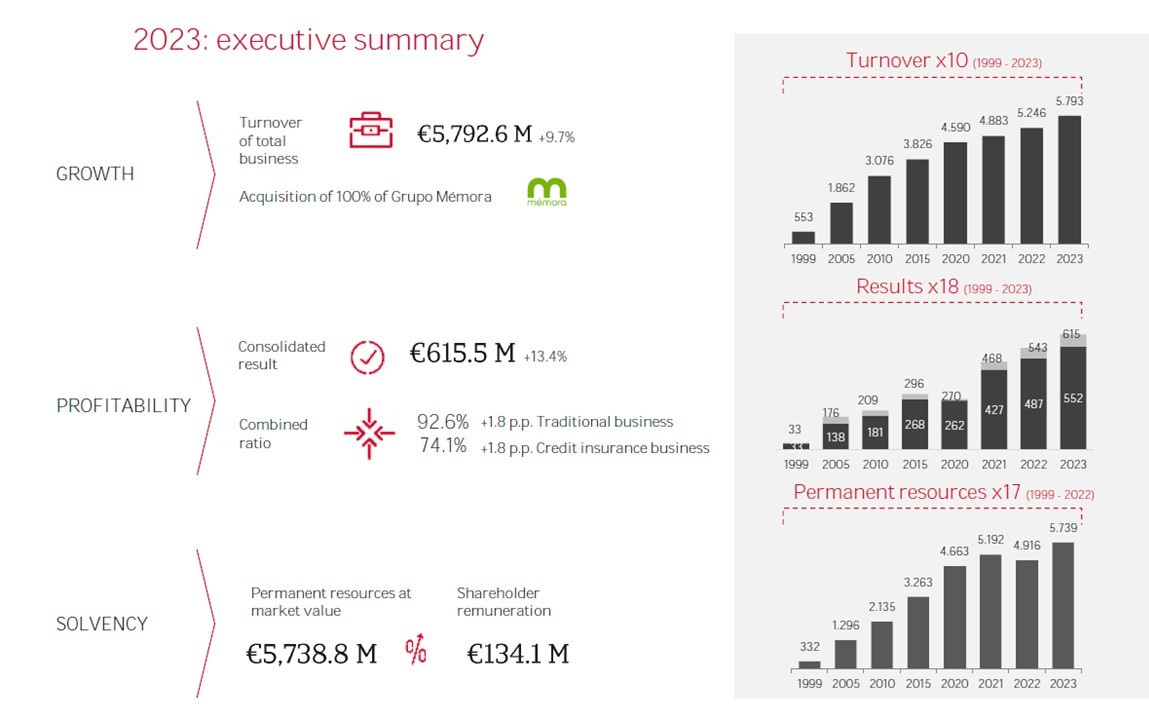

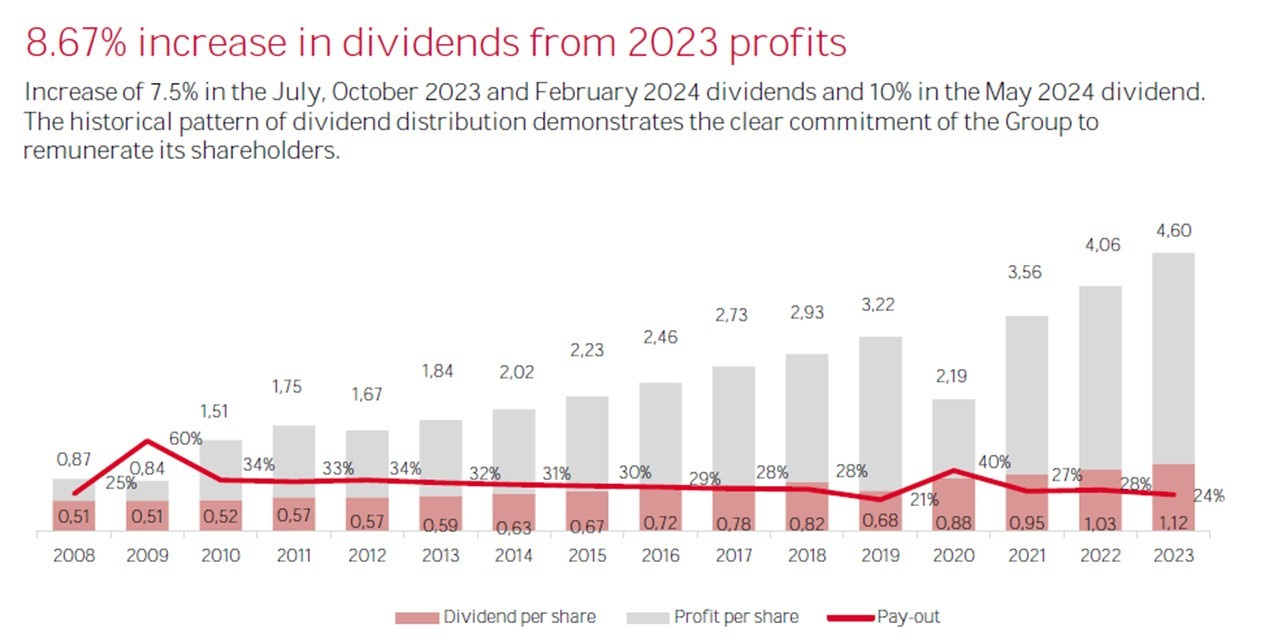

Since the initial post more than two years ago, Grupo Catalana Occidente has continued doing what it does best: grow its underlying business (premiums/turnover)1, profits, owner’s capital and dividends. Performance was strong across all business areas, and GCO consistently makes money in an environment in which the rest of the Spanish listed insurers are mostly suffering losses: all this while maintaining an excellent combined ratio (well below the 100% level) and a solid solvency position.

GCO continues to execute on its strategy of profitable growth, including small, ad-hoc acquisitions. However, I’m a bit baffled by the purchase of Grupo Mémora, the leading funeral services group in the Iberian Peninsula, for roughly €400 million: I’m not sure what the synergies with the insurance business are…

The stock (up +21% YTD and +47% including dividends since the post ) is still cheap at a P/E of 8x and P/TBV of 1.1x for a 15% ROTE. As also pointed in the initial report, some shareholders would like to see more decisiveness from the management team to unlock the massive upside potential that the market does not seem to perceive (special dividends and/or share buybacks have been mentioned several times). But this is not in the Serra family’s DNA: let’s just hope they don’t use the more than €1 billion "idle" that the company has been accumulating on its balance sheet for some time for a transformative deal (unlikely to happen, but still need to monitor it).

Interesting readings

Inside EV startup Fisker’s collapse: how the company crumbled under its founders’ whims

Joel Greenblatt's Greatest Investment tells the story of how Greenblatt was inspired to start the Value Investor Club

Memories of an Enron summer: this short piece recounts this guy’s time as an intern at the firm the year before it blew up

As a follow-up to my China macro post:

Resignation Bordering on Despair

Stock pitches

Sweet Stocks: Bekaert

ToffCap: Basif-Fit fully agree with ToffCap’s take: I also never understood why so many analysts are enamoured with Basic-Fit

The new IFRS 17 for Insurance Contracts makes historical comparisons more complicated and not so direct