Monthly recap #2

An update on a previously discussed position, and other interesting news from October

Blackstone Loan Financing Limited

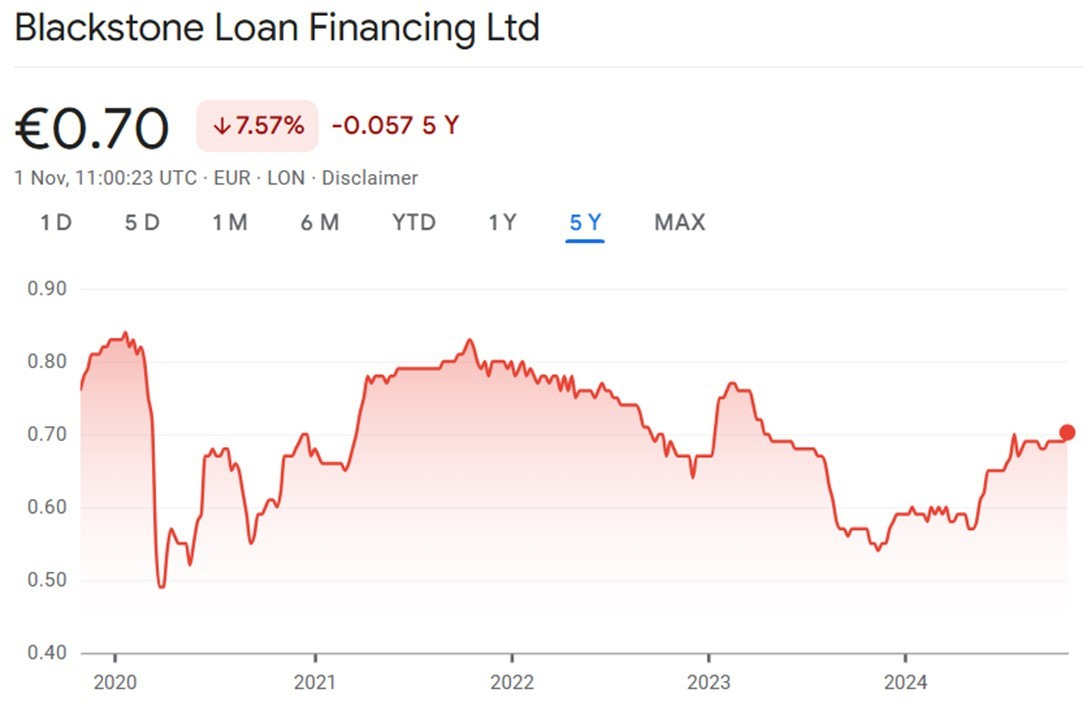

Since the original analysis published 18 months ago, BGLF has returned a cumulative 18%, with 17% coming from dividend distributions (+12% annualised over ~1.5 years): that was to be expected, as the fund invest predominantly in floating rate senior secured loans and it was indeed positioned as a yield play:

“To buy or not to buy?

If you’re looking for something that will compound over time and outperform equity markets, this ain’t it: this is purely a yield play, with regular dividends paid out every quarter from a portfolio of credit instruments.”

Over the same period, an ETF of Euro Investment Grade bonds ($VECA) gained a cumulative 6% and Euro High Yield bonds ($HIGH) did 9%. According to the managers data, in the year to September 2024 NAV for BGLF appreciated by 11.2%, easily beating both European (+8.1%) and US Loans (+9.6%). However, it was the opposite in the 12 months to September 2023: while still decent, BGLF’s performance (+9.1%) lagged the loan indices (13.7% for European and 12.5% for US).

After a rough 2023 (-12%), the stock price has recovered and is up +19% YTD.

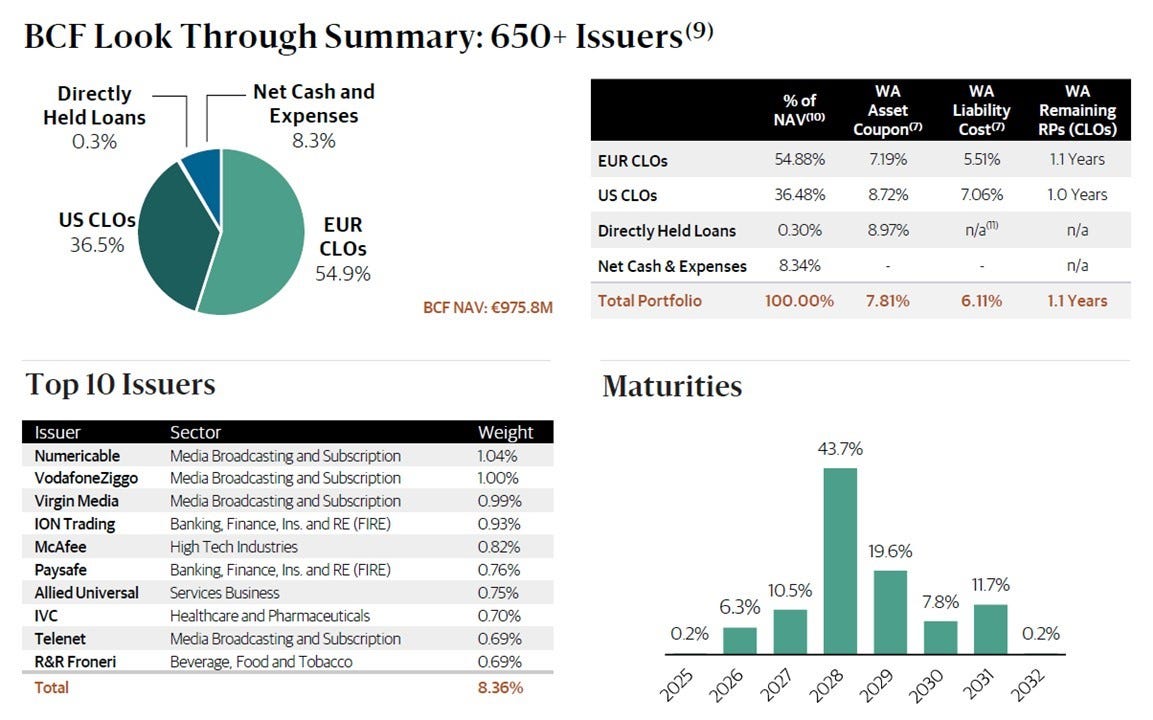

BGLF still has an attractive yield (14%) and a very diversified underlying portfolio (650+ issuers, today more geared towards Euro CLOs – 55% of NAV): biggest industry by exposure is Healthcare (16%), followed by Services (12%) and Hi-Tech (10%). 77% of the portfolio is rated “B”, with only 8% rate “CCC” or less.

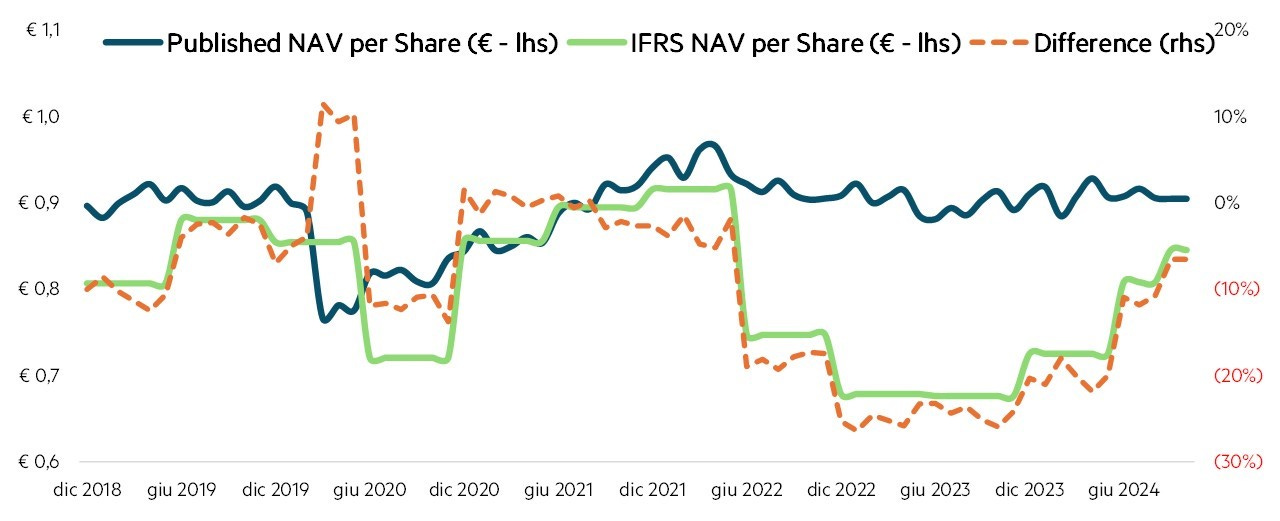

The problem remains the discrepancy between published and IFRS NAVs (discussed in details in the original post): as at September 2024, the published NAV is €0.9045 (implying a currently 23% price discount) while IFRS (“mark-to-market”) NAV is €0.8451 (for a smaller 17% discount). The current “difference” between the two reported measures is the smallest since mid-2021: for limited periods in 2021 and 2021 the IFRS NAV was actually higher than reported NAV, reflecting market dislocations in those months.

Big movers

Companies in the European SMID space with “big movements” (both up and down) during the month of October that are worth researching further.

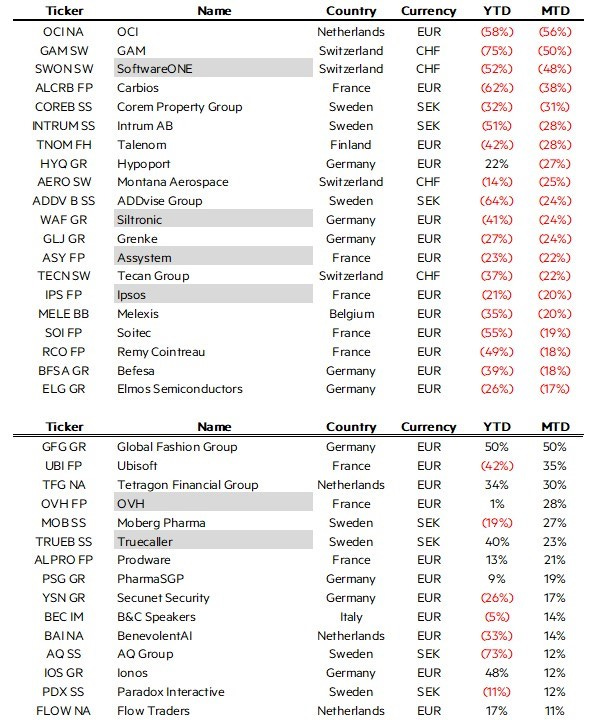

Assystem and Ipsos were both down during the month as they cut guidance for full-year results. Siltronic declined on no specific news (Q3 was actually positive), just riding the negative trend in the semiconductor sector: Soitec, Melexis and Elmos Semiconductors were also significantly lower.

During last week, the three Georgian financials mentioned in the Stranger Things were initially impacted by the results of the national elections, but then recovered: TBC Bank Group was down -3% for the week, Georgia Capital just -1% and Bank of Georgia was actually up +5%! As discussed in the post, I still like them a lot long-term (particularly CGEO), but at the moment it’s anyone’s guess how the political situation will evolve in Georgia.

Oh, and maybe I should stay out of “companies with a catalyst”: SoftwareONE (my very latest post on Oct. 25) crashed almost -50% in two days since it announced on Oct. 31 that it will immediately replace the CEO after slashing full-year revenue growth forecast on a weaker-than-expected third quarter. To my partial credit (not much, I know…) I did say that stock was expensive on current fundamentals and that, while the new board elected in April was more inclined to a buyout offer, that was far from a sealed deal:

“The VAR space is very competitive and faces persistent margin pressure from both clients and vendors. It is also facing disintermediation: cloud deployment makes self-service or vendor-service logistically easier, conceptually threatening the VAR model. Considering the recent developments at the company, it is difficult to see Bain, Apax or anyone else making a blowout bid. At the mid- to high-end of Bain’s previous indicative offers (CHF 19 / CHF 20.50), that would be a premium of 45% to 55% above the current price (around CHF 13): not a bad return, but very uncertain in terms of timing and outcome.

Obviously, the price could still re-rate up even without a new bid if management hits the targets for 2025 and 2026. (ndr: not going to happen!)

A stock to trade, rather than to own.

Interesting readings

McKinsey - Beyond the balance sheet: North American asset management 2024

Rupak Ghose - Remembering Queen's Walk: Private credit rush to ETFs reminds me of permanent capital bubble pre GFC

OpenAI and Anthropic Revenue Breakdown - Breaking down revenue growth, the consumer subscription businesses and the importance of partnerships to the API business