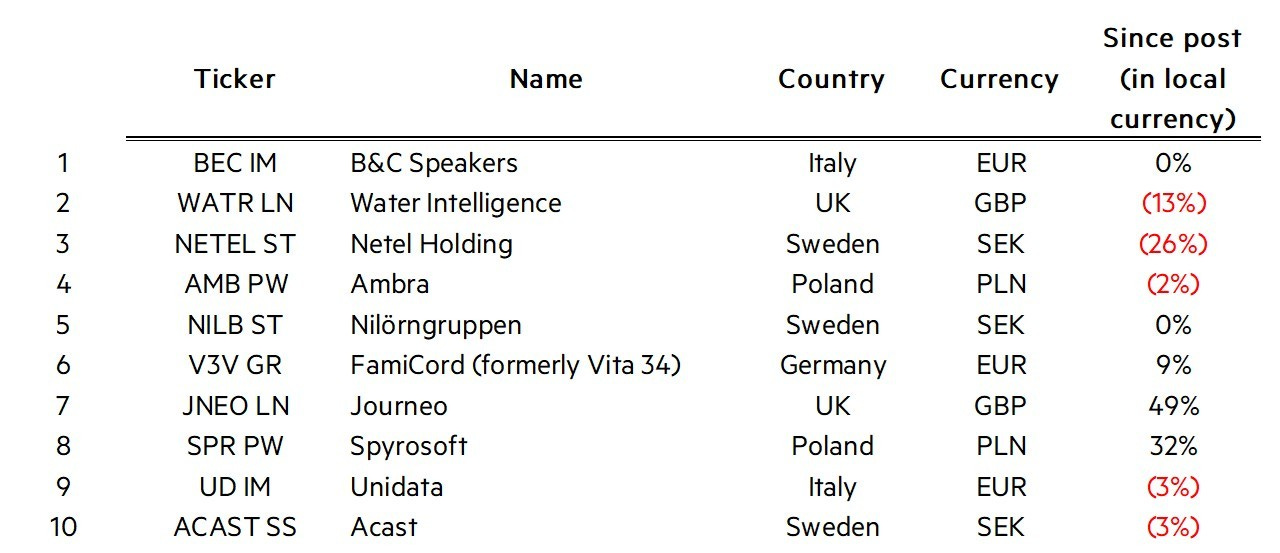

A quick recap with the performance of all companies discussed in this Substack since its inception, in chronological order, split in two tables for ease of reading.

Notes:

SimCorp has been acquired by Deutsche Börse

Grupo Catalana Occidente and Corporación Financiera Alba have been taken private by their respective controlling families

Blackstone Loan Financing Ltd is currently finalising the winding-up / liquidation process

Fondul Propriatatea has IPOed its biggest holding Hidroelectrica and distributed the shares to stockholders: the fund is now left with few, mostly unlisted, assets. The performance above does NOT include Hidroelectrica (whose stock is up +18% since IPO)

Just a reminder: you probably know by now this has never meant to be a stock picking newsletter: I never say “Buy this / sell that because I know what will happen!” What I do is to provide the business analysis and a quick, back-of-the-envelope valuation of each company.

However, most of the times I do comment on the merits and “attractiveness” (or lack thereof) of these companies: so it’s only fair to make some observations on the worst calls.

Aker Horizon (IRR -51.3%):1 an investment company IPOed in February 2021 to hold Aker ASA’s assets in green tech and renewable energy (Aker ASA owned 76% of the shares at the time, now around 67%). When I first wrote abot AKH, it was already down ~50% since the IPO, and it proceeded to lose another ~90%: it was worth US$1.2 billion at the time of the post and it’s around US$100 million today. It tried (unsuccessfully) to reverse the previous strategy, merging with its listed subsidiaries Aker Offshore Wind and Aker Clean Hydrogen and selling a minority stake in Mainstream Renewable Power to Japan’s Mitsui. It’s the periodic reminder that “long shots almost always miss the target”: it doesn’t matter how promising a theme or industry can be in the long term, that alone is not a guarantee of success, even if you partner with successful managers (in this case the Røkke family behind Aker ASA)

doValue (IRR -39.3%): while the total performance has been less severe than AKH, the analysis was even more flawed. Indeed, in the original post I said:

“[…] strictly speaking, doValue (DOV IM) is not a bank: it is more akin to an asset manager, earning fees from a portfolio of non-performing loans (NPLs) that it manages for third parties.”

One of the plus to a long position was identified as the ability to deploy its balance sheet for accretive M&A: not only the acquisitions and expansion beyond Italy have not grown NPLs volumes as expected, but both earnings and ROE suffered (in 2020 and 2021 the company likely over-earned thanks to favourable post-pandemic taxation and government support). What seemed to be be a fairly priced stock turned out to be very expensive: dividends were also suspended after 2022. The fact that Elliott Management got a 18% stake as a consequence of DOV buying Gardant didn’t help much the share price: the company overstretched itself with the expansion strategy, and sacrificed profitability to the altar of size (i.e., the problems were company-specific and idiosyncratic, rather than macro or industry-wise)

Mayr-Melnhof (IRR -23.4%): I did warn that:

“this is a 2 to 5 years investment story (no real catalyst for a quick re-rating on the horizon): the attractiveness of MMK packaging business models remains intact, but the full-realisation of the underlying potential of the investments in acquired and organic growth will require time.”

Nevertheless, my back-of-the-envelop valuation was way off (€195 vs €75 currently!). The negative trends already evident at the time of writing continued in the following months: competition and lower demand pushed price for containerboards well below the pandemic boom years, which hit the entire industry (not just MMK). Sales decreased at MMK in 2024 (although by only 2%), putting more pressure on margins, profitability and cash flows

Petershill Partners (IRR +21%): it might seems a paradox to list a company with a +21% IRR as a bad call; the problem is that after a lenghty and detailed analysis my conclusion was:

“[…] do you trust Goldman Sachs to be making its best effort to turn this listed vehicle into a success after all? […] I’m probably too cynic, but I stand by: “Never buy what a Goldman banker is selling!” (and I say this with the utmost respect for GS's ability to make money in everything, not in a derogatory way).

I should have indeed trusted the boys & girls at GS more!!!! As a partial amend, I also said:

“[…] due to the recent weakness in the sterling pound and UK equities in general, the price has become very, very attractive. It won’t take much (a combination of growth and multiple expansion) to earn a decent if not excellent return.”

While the total return to today is +61%, the stock price is “only” up by 18%: an astounding 43% of the return has come from the dividends the company has paid (both ordinary and special).

And now let me gloat with some good calls:

VNV Global (IRR -17.4%): similar to Petershill but with opposite results, I was sceptical of the near term prospects for most VC-backed companies and the stock price did indeed go down:

“Despite a good track record (+26% p.a. NAV IRR – including distributions - since 2012), and for as much as I like some of the shareholders, I’m not convinced this is yet a good entry point: the de-rating for many disruptors has just started, and many companies will find it extremely difficult to finance not only their future growth but even their existence. Related to this point, I’m not a big fan of the mobility segment: there are too many companies competing in the space for the same end customers, and underlying unit economics still do not make sense.”

Shareholders in one of its main assets (Babylon) have been wiped out in a restructuring and the positions in the mobility segment have been a disaster (Swvl -96%).

Logista (IRR +23.8%): this wasn’t difficult to identify (“Not a melting ice cube!”), the market was too focused on the tobacco business (where Logista is only a distributor to proximity and a tax collector for governments), and ignored the remaining distribution business, including pharmaceuticals, that now is more than 50% of revenues

VEON (IRR: n.a.): published less than a year ago in September 2024, it was another undiscovered gem in plain sight, an orphan stock ignored by both the sell- and buy-side for its disparate collection of assets in frontier markets (Ukraine, Uzbekistan, Pakistan, Bangladesh, …). But the assets were there, and it was only a question of crystallising their value: it did by first delisting from Euronext Amsterdam and leaving only the Nasdaq listing, and then by announcing the merger of its subsidiary Kyivstar (Ukraine’s leading digital operator, both mobile and fixed-line connectivity) with the with Cohen Circle Acquisition Corp I SPAC (expected to be concluded in Q3 2025). The stock is up +62% since the post

Warsaw Stock Exchange (IRR +13.7%): it took a while for the thesis to play out (it was posted one month before Russia invaded Ukraine…), but it was again the classic cheap, overlooked asset:

“GPW is however a very profitable organisation with a strong balance sheet that is somewhat overlooked: while growth has not been spectacular, this is a wide moat company that is growing its trading volumes and information services. It is also selling at a highly attractive valuation (~20% of the market cap is covered by net cash and another ~14% by equity investments), where the bear case gives some downside protection.

It seems reasonable that someday Poland will experience a resurging market. Whether that happens tomorrow or in 10 years, who knows. But the optionality is on the upside: it’s like a cheap call option that if Poland has a (relatively stronger) equity market, GPW will do very well.”

That’s exactly what happened.

Other stocks mentioned

For completeness, here is also the performance of the stocks mentioned in “Stranger Things” and “10 microcaps for 2025”

Some good calls in the more “exotic” list in Stranger Things:

Despite the continuous protest in Georgia against the government, the two local banks (TBC Bank and Bank of Georgia) have performed very well, and Georgia Capital even better:

“If I were asked to only choose one, my chips would be on Georgia Capital: good management and a linear proxy on the growth of the country with assets across all industries.”

The other Eastern European banks (Moneta Money Bank in the Czeh Republic and Artea Bankas in Lithuania) were also positive

Finally, good performance from the agri companies, the very illiquid “SocFin” complex and particularly Astarta Holding (listed in Poland but with operations in Ukraine)

On the other hand, Grit Real Estate Income Group (a London-listed pan-African impact real estate investor) continued its negative trend, plagued by the substantially discounted capital raises needed for a series of acquisitions underpinning its plan for growth.

IRR is calculated including all dividends received during the holding period